- The Savvy Promise

At Savvy, our mission is to empower you to make informed financial choices. While we maintain stringent editorial standards, this article may include mentions of products offered by our partners. Here’s how we generate income.

In this article

As part of Savvy’s ongoing economic research, we look at property market conditions in the most and least expensive suburbs to buy in.

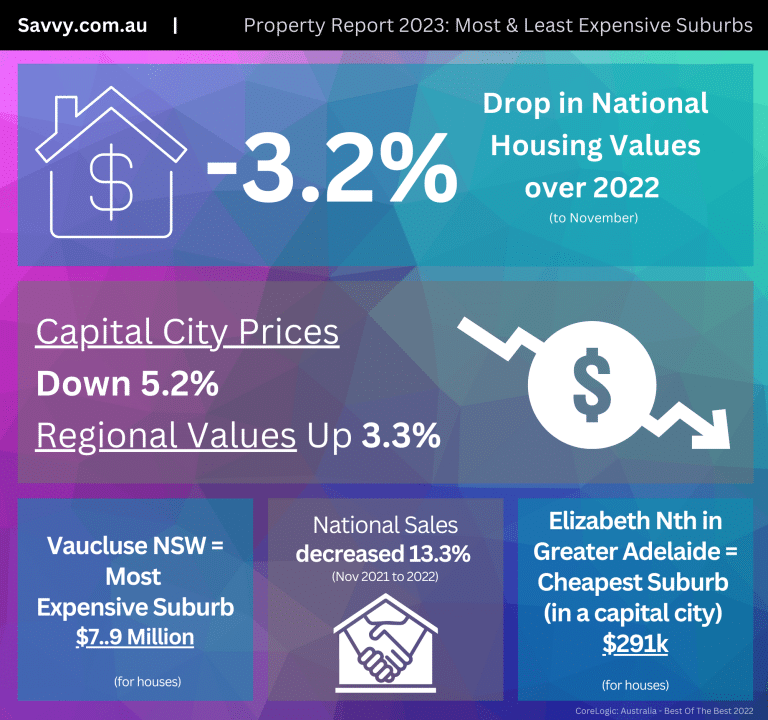

- National housing values decreased by 3.2% over 2022 to November

- Vaucluse, NSW was the most expensive suburb for houses

- Kambalda East, WA was the most affordable suburb for houses

- Elizabeth North in Greater Adelaide was the cheapest suburb for houses of the capital cities

- Capital city prices down 5.2%, regional property values 3.3% above 2021 baseline

If you were a property investor or looking to buy your first home during 2022, you were likely swept up in equal moments of jubilation and despair as inflation continued to choke the economy, interest rates rose to their highest levels since October 2009 (3.25%), and uncertainty reigned supreme. Despite higher interest rates, overall housing prices are down.

According to recent research by national housing analytics firm CoreLogic, national housing values decreased by 3.2% over the year to November, driven by a 5.2% annual reduction in capital city dwelling values, while regional dwelling values increased by 3.3% over the same period.

Residential real estate's predicted global market value dropped from $9.6 trillion in December 2021 to $9.4 trillion in November 2022. With almost 535,000 residences sold nationwide, estimated yearly sales decreased 13.3% compared to 2021 (to November 2021.)

So what are the most expensive – and conversely least expensive – suburbs or postcodes to buy property in around Australia? What does the residential property market look like at the moment? We look at the real estate data for 2022 and answer your property valuation questions.

A snapshot of the residential property market in 2022

As we all know, the RBA has lifted the official cash rate from a record low 0.1% to 3.35% in each successive month since May 2022. This is part of their remit to combat inflation, which also stands at a significantly high 7.8% (generalised throughout the economy.)

The typical new owner-occupier loan's monthly mortgage repayment in April was $2,399 with a 20% down payment and a 30-year loan term. Though, by average, the loan principal would have decreased by more than $42,000, if the rate increases from November and December are fully passed forwards by the banks, the average variable rate would increase to 5.08%, increasing monthly mortgage payments by around $698 on average.

The effects of higher interest rates are far from uniform. When compared to high-density and regional markets, more costly housing alternatives, such as detached houses and capital city markets, have often experienced bigger value reductions.

While combined capital city prices decreased by 5.2%, combined regional property values are still 3.3% higher than they were at this time last year.

This is similar to how capital city home prices fell by 5.5%, capital city unit (apartments, flats, etc.) values had a smaller 4.3% dip.

The yearly change in housing values in the nation's key cities ranged from an overall loss of 10.6% in the Greater Sydney market to an increase of 13.4% in values in Adelaide.

Regional markets continue to provide reasonably priced price points despite stronger value increase during the upswing; the combined median regional dwelling value is around $200,000 less than the combined median capital city dwelling value.

Because they demand larger debt levels to access, more expensive housing markets may have been more sensitive to recent rate increases. According to the graph below, the top 25% of home prices in Australia have historically had greater upswings and harsher drops, whereas the middle and lowest quartiles of the market have witnessed more gradual changes.

What is the most expensive suburb to buy into in Australia?

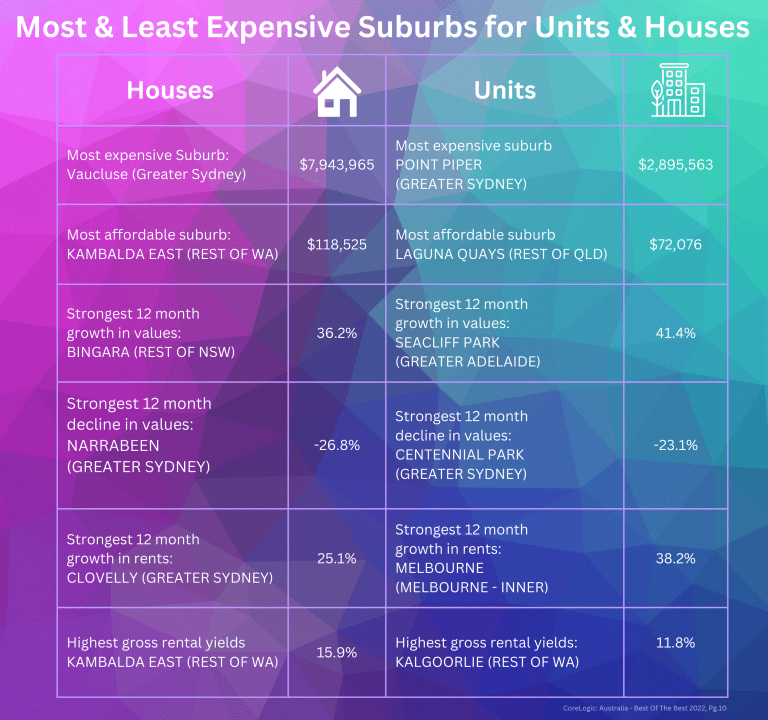

When it comes to houses, the most expensive suburb to buy into is the leafy and upmarket suburb of Vaucluse in Greater Sydney, with an eyewatering median house price of $7,943,965. The most expensive suburb to buy units is also in NSW, in Point Piper at $2,895,563.

The suburb with the strongest 12 months of growth in values was Bingara in NSW at 36.2%. The strongest 12-month growth in values for units was Seacliff Park in greater Adelaide, climbing 41.4%.

The strongest 12-month growth in rents for houses was Clovelly in Greater Sydney on 25.1%. Curiously, the highest gross rental yields were in Kambalda East on 15.9%, perhaps due to the demand for mining accommodation. The highest 12-month growth in rents for units was in Inner Melbourne on 38.2%, and the highest gross rental yields for units was in Kalgoorlie with 11.8%.

What is the most affordable suburb to buy into in Australia?

The least expensive suburb or most affordable suburb to buy residential property is Kambalda East, in the east of WA with a median house price of $118,525. The cheapest suburb to purchase a unit was Laguna Quays in Queensland at a rather modest $72,076 (you can buy a decent electric vehicle for that price!)

The strongest 12 month decline in values of residential houses was in Greater Sydney’s Narrabeen, declining 26.8% with Centennial Park experiencing a dip of 23.1% in unit values.

Property value breakdowns of capital cities

As mentioned, the most expensive suburb to purchase a house in a capital city was Vaucluse, followed by Bellevue Hill with a median of $6,882,484 and Rose Bay on $5,660,910. All three suburbs are found in Greater Sydney.

The most affordable suburbs are Elizabeth North in Greater Adelaide with a median house value of $291,526; Kwinana Town Centre in Greater Perth is next with $300,252, and Elizabeth Downs in Greater Adelaide at $305,336.

As for units, Point Piper comes first, with Darling Point next on $2,371,718 and Millers Point on $2,111,672 – the “point” being anything named Point in Greater Sydney will likely have expensive units for sale (suburbs with “point” in their name appear four times in the top ten most expensive list.)

The most affordable or least expensive suburbs for unit purchases is Orelia in Greater Perth with a median value of $183,522, followed by Greater Brisbane’s Kooralbyn ($202,039) and Goodna ($233,334).

Property value breakdowns of regional centres

The most expensive suburbs in the regions for residential houses are all found in NSW. The first being Ewingsdale with a median house price of $2,972,218. This is followed by Burradoo on $2,353,875, and alternative lifestyle enclave Byron Bay on $2,307,592.

The most affordable housing suburbs are the aforementioned, somewhat isolated Kambalda East, followed by Peterborough in SA on $130,627. Kimba in SA comes in at third on $133,975.

The most expensive suburbs to purchase a unit is in Noosa Heads in Queensland, with a median value of $1,409,790, followed by Byron Bay at $1,383,184, and Main Beach, Queensland at $1,229,545.

The most affordable suburbs to buy into for units is the Laguna Quays ($72,076), followed by Dolphin Heads at $113,697, and Withers in WA on $131,547.

A look at the states

NSW

The most expensive suburb to buy houses and units were, as mentioned, in Vaucluse and Point Piper.

The most affordable suburb in NSW to buy a house was in Peak Hill at $180,870. The most affordable suburb for units is Lavington on the Murray with a median house price of $251,406.

VIC

The most expensive suburb to buy a house in Victoria is Toorak, with a median house price of $4,955,630. The most expensive suburb to buy a unit is Beaumaris at $1,209,944.

The most affordable suburb to purchase a house in Victoria is Hopetoun in the North West, with a median house price of $178,811. The most affordable suburb for buying units is the regional Gippsland town of Moe on $245,467.

QLD

Queensland’s most expensive suburb to buy a house in was Sunshine Beach, with a median price of $2,198,404. As mentioned, Noosa Heads was the most expensive suburb to purchase a unit in.

The most affordable suburb for houses is Tara in the Darling Downs at $146,122, and for units, the previously mentioned Laguna Quays.

WA

One can find the most expensive suburb to buy a house in WA in Peppermint Grove with a median house price of $3,178,788. The most expensive suburb for units is North Fremantle in Perth’s South West, with a median house price just shy of $1m – $902,683.

The most affordable suburb as discussed was Kambalda East, with the most affordable suburb for units being Withers in Bunbury at $131,547.

SA

Much like their Victorian cousins, the most expensive suburb to purchase a house in South Australia is Toorak Gardens, with a median house price of $2,067,074. Kent Town is the most expensive suburb to purchase a unit, averaging $655,239.

The most affordable suburb for house purchases is Peterborough, with a median house price of $130,627. The most affordable suburb for units is Mount Gambier with a median unit price of $245,692.

TAS

Tasmania’s hottest property market for houses was found in Hobart’s Battery Point, with the median topping out at $1,464,685. It was also the most expensive suburb for units, with a median price of $865,562.

The most affordable suburb for houses was Rosebery on $163,884 and Mowbray for units on $333,200.

NT

Darwin’s most expensive suburb is in Nightcliff, with a median house price of $919,048. Units are most expensive in Bayview at a median price of $547,739.

The most affordable suburb for houses is the outback town of Tennant Creek, with houses costing a median $239,590. The most affordable suburb for units is Bakewell in Darwin, topping out at $284,341.

ACT

Our smallest territory’s most expensive suburb for house prices is Griffith at $2,265,479; units are the most expensive in Yarralumla, at $1,124,600.

The most affordable suburb for houses is Belconnen at $614,531; the most affordable suburb for units is Curtin at $405,491.

What’s next for the Australian property market?

The housing market will be shaped largely by what the Reserve Bank does – or doesn’t do – next. Increases in interest rate usually correspond with lower demand for property, which drives prices down.

As for consumer sentiment, the “time to purchase a house” component of Westpac-Melbourne Institute consumer mood survey increased by 2.4% over the course of December.

Adrian Edlington, Savvy’s finance spokesperson, says that waiting for prices to hit rock bottom as rates continue to rise may be a bit of a ‘fool’s errand.’

“Right now, house prices are falling across the board, and some may be waiting to pick up a bargain at the floor, which means first time buyers and investors are at the upper hand in negotiation for the first time in a long time,” he says.

“This advantage may be short lived, though. If you wait for houses to hit the absolute rock bottom prices, chances are you’ll be locking in an interest rate that’s at the highest it’s been since the end of the Global Financial Crisis. It’s doubtful we’ll see the ‘bad old days’ of seventeen percent rates like we did in the 1990s, but even slight upticks in RBA cash rates can make all the difference between servicing a loan for some and missing out entirely.”

Did you find this page helpful?

Author

Savvy Editorial TeamPublished on February 22nd, 2023

Last updated on March 14th, 2024

Fact checked

This guide provides general information and does not consider your individual needs, finances or objectives. We do not make any recommendation or suggestion about which product is best for you based on your specific situation and we do not compare all companies in the market, or all products offered by all companies. It’s always important to consider whether professional financial, legal or taxation advice is appropriate for you before choosing or purchasing a financial product.

The content on our website is produced by experts in the field of finance and reviewed as part of our editorial guidelines. We endeavour to keep all information across our site updated with accurate information.