- The Savvy Promise

At Savvy, our mission is to empower you to make informed financial choices. While we maintain stringent editorial standards, this article may include mentions of products offered by our partners. Here’s how we generate income.

In this article

Savvy's 2022 cost of living survey learns how interest rate hikes are affecting Australian mortgage holders.

- 44% of Australian mortgage holders spend between $251-$500 in weekly repayments

- 23% of mortgage holders spend $501-$750, and a further 18% spend $751 and over

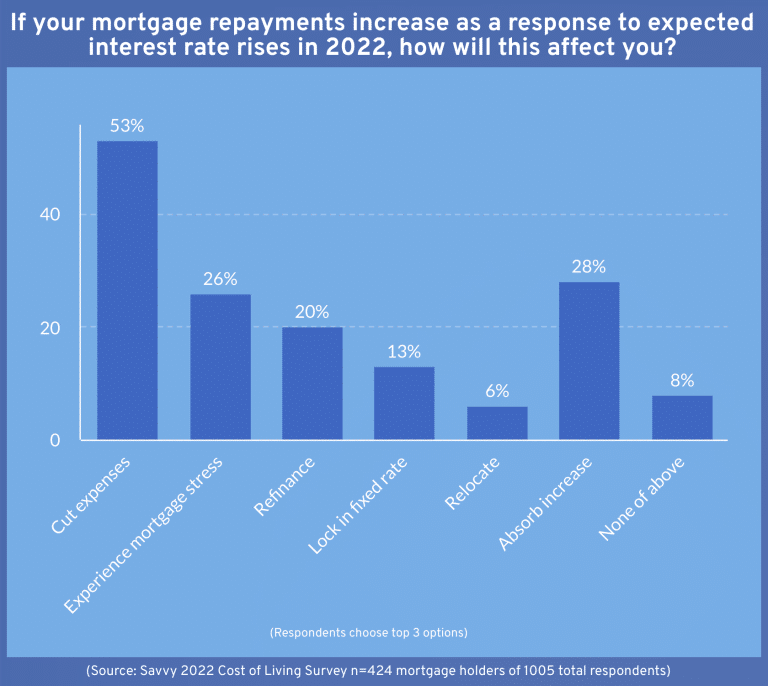

- 53% will cut down on other expenses to prioritise mortgage, 28% will absorb increase, 26% will experience mortgage stress

- 38% of 25–34-year-olds and 35–44-year-olds identify mortgage repayments as a major cost of living stress

A nationally representative Survey conducted by Savvy has shown that 26% of respondents (n=1005) have cited mortgage repayments as a significant cost of living concern.

Extrapolated to the general adult population, this means 5.05 million Australians may be worried about keeping up with mortgage repayments in the coming months.

38% of 25–34-year-olds and 35–44-year-olds said that mortgage repayment increases are a significant concern when it comes to their ability to keep up with the cost of living. Other age groups expressed a lower level of concern about mortgage repayments; 25% of 18-24s, 32% of 45-54s, 18% of 55-64s and only 6% of those aged 65 and over.

According to the survey, 43.86% of mortgage holders spend between $251-$500 on repayments each week, while 23% spend between $501-$750. A further 18% claimed to pay $751 and over per week to cover their mortgage.

The survey identified 8.1 million (42% of n=1005) Australians as having a mortgage.

Mortgage stress imminent

Mortgage stress as defined by the Australian Bureau of Statistics is a financial situation in which a homeowner or household is using more than 30% of their after-tax income to keep up with mortgage repayments.

Research firm Roy Morgan considers homeowners “At Risk” of mortgage stress if they are spending between 25%-45% of their income on their mortgage; an “Extreme Risk” if they are expending 45% of their income on their home loan repayments. They estimated 584,000 mortgage holders were “at risk” at the end of 2021.

A single person earning the average weekly wage ($1,813) would be at risk of mortgage stress if their weekly repayments exceeded $545.

Bill Tsouvalas, Savvy Managing Director & personal finance expert;

“If that twenty-three percent who said they have mortgage repayments $500 to $750 per week were single income households, they would be in real trouble,” Bill Tsouvalas, CEO of Savvy says. “The COVID mortgage holidays are over and for some families, there may not be much left in the tank when it comes to covering mortgage repayments.”

When asked to choose their top three responses to mortgage repayment increases resulting from an interest rate rise, 53% of respondents said they would try to cut down on other expenditure to prioritise their mortgage. 28% of mortgage holders said they will absorb the increase, while 26% said they will simply grit their teeth and experience mortgage stress.

20% said they’re prepared to change lenders or refinance; 13% will lock in a fixed rate with their current lender.

Bill Tsouvalas, Savvy Managing Director & personal finance expert;

““If you can refinance at a lower rate – lock it in now,” Tsouvalas says. “Nought point eight five percent is still a record low; so get around to refinancing or fixing your rate as a first priority. Another option is to consider paying off all of your miscellaneous debts with a debt consolidation loan, to secure a more competitive and manageable interest rate. Once you have a handle on your other debts, it can make it easier to focus on your mortgage.”

If you are experiencing acute mental stress due to finances, contact Beyond Blue on 1300 22 4636 or Lifeline on 131 114.

Savvy - 2022 Cost of Living Survey (n = 1005)

Sources:

ABS.gov.au - Mortgage Affordability Indicator 2021 - MAID

RoyMorgan.com - Mortgage Risk During COVID-19 Pandemic - September 2021

Did you find this page helpful?

Author

Adrian EdlingtonGuest Contributor

Bill TsouvalasPublished on June 20th, 2022

Last updated on March 18th, 2024

Fact checked

This guide provides general information and does not consider your individual needs, finances or objectives. We do not make any recommendation or suggestion about which product is best for you based on your specific situation and we do not compare all companies in the market, or all products offered by all companies. It’s always important to consider whether professional financial, legal or taxation advice is appropriate for you before choosing or purchasing a financial product.

The content on our website is produced by experts in the field of finance and reviewed as part of our editorial guidelines. We endeavour to keep all information across our site updated with accurate information.