- The Savvy Promise

At Savvy, our mission is to empower you to make informed financial choices. While we maintain stringent editorial standards, this article may include mentions of products offered by our partners. Here’s how we generate income.

In this article

Do you know what your credit score is, or what’s on your credit history?

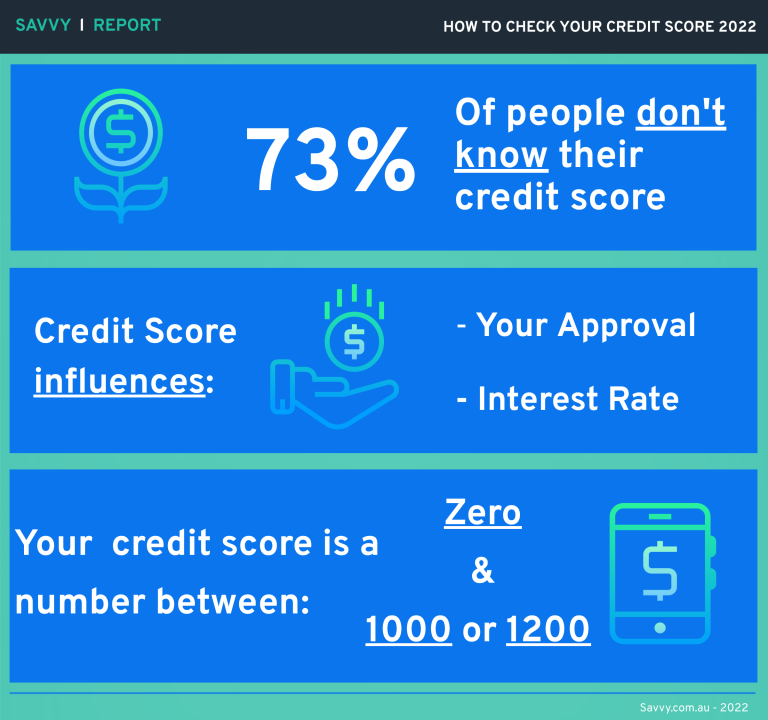

- 73% of Australians don’t know their credit score.

- Your credit score is a number between zero and 1000 or 1200.

- Knowing your credit score is integral to your financial health.

- A determining factor in whether you’re approved for finance and at what interest rate.

- Average Aussie credit score falls between 664 and 706 – which is “average” to “good.”

- 13% of women drivers are spending between $121-$160 on fuel

It has been said that 73% of Australians don’t know their credit score, however knowing your credit score or credit rating is integral to your financial health. It can be a determining factor in whether you’re approved for finance and at what interest rate. In Savvy’s latest report, learn all you need to know about checking your credit rating and credit score in Australia, updated with the latest information for 2022.

What is a credit rating or credit score?

A credit score or credit rating is like your “report card” or track record in applying and paying back credit or financial products such as home loans.

The official definition according to the Australian Securities and Investments Commission, which regulates borrowing and credit in Australia, is “a number based on an analysis of your credit file, at a particular point in time, that helps a lender determine your creditworthiness.”

Your credit score will be a number between zero and 1,000 (or in some cases zero and 1,200.) The higher your credit score, the ‘better’ your credit is. The lower the score, the worse your credit is.

Your credit rating is tied to your credit score. A low score means a low rating; a high score means a high rating. These are bundled up into bands: below average, average, good, very good, excellent.

In Australia, the average credit score falls between 664 and 706 – which is between the “average” to “good” category.

How is the score calculated?

The simple explanation is the score is based on how much money you’ve borrowed, the number of credit applications or checks you’ve made (or authorised), and whether you pay back your credit on time and/or in full.

Who calculates these scores?

In Australia, there are three credit reporting bureaus that keep record of your credit score and credit history. These agencies are Experian, illion, and Equifax. These are specialist firms that gather information about credit and loans for banks, telcos, and other institutions that need financial information about potential customers. These agencies don’t always hold the same information – you may have different credit reports with different agencies, which may influence your overall credit score.

What is a credit history?

A credit history is an itemised list of all the major “credit events” that have occurred on your credit file. Your history shows when and where you applied for a loan, applied for a credit card, whether you pay back your loans on time, if you’ve defaulted (paid late or not at all) on bills or loan repayments, if you’ve hit or come close to your credit card limit, if you’re party to bankruptcy or debt agreements, if you’ve gone to court over debts, and of course, if or when you’ve checked your credit history.

Why do I need to check my credit score or history?

Checking your credit score is good practice for maintaining your financial “health” and reputation as a responsible borrower – knowing what financial products may or may not be available to you ahead of time can give you pause to reassess your finances and start making better financial choices.

Your credit history may also contain errors on it, which can affect your credit score. If you have errors on your credit history, it is your responsibility to dispute these errors and have them removed. Removing defaults or other negative events from your credit history improves your credit score.

Why do I need a good credit score?

A good credit score increases your chances of being approved for finance – for greater amounts (e.g. for car loans or mortgages) and lower interest rates. A higher score means you are a lower risk – a lower score is the opposite. Lower scores will negatively affect your ability to get a loan or credit.

How much does it cost to check my credit score?

It’s free to check your credit score once every year with the three credit reporting agencies listed above. You can view your report and score for free each year, provided:

- You have had an application for credit rejected within the last 90 days.

- If you’ve asked for errors on your report to be fixed, to check it’s been corrected.

- If you’ve not accessed your report in the last 12 months.

Otherwise, the credit reporting agencies may charge a fee. Some agencies may give you access to regular reports for a monthly fee. Depending on the agency, you may be able to access your report once every three months.

How much does it cost to check my credit history?

It’s also free to check your credit history once every year. The same criteria apply as above.

When should I check my credit score?

It’s recommended you check it once per year. Month to month, your credit score will see little movement. If you are applying for a major loan like a mortgage, it may be worth paying for extra reports every three months to see if your score is improving. You can check your score as often as you like: but you will have to pay for the privilege.

What does a credit score influence in terms of finance?

A credit score influences whether you are:

- Approved for finance or not, and,

- At what interest rate.

If you have a good credit score, banks and lenders are more inclined to approve you for finance. The better the score, the more likely they will pass on savings in the form of lower interest rates. This is because you have a lower risk profile. This also gives you an upper hand in negotiating lower interest rates if you are refinancing your loans, for example.

People with “excellent” or very high credit scores may also access non-traditional lending such as Peer to Peer (P2P) lending. This matches borrowers with private lenders who lend as an investment. Before looking at P2P lending, make sure to research the fees, service provisions, and other information as P2P lending can carry significant risks.

According to Bill Tsouvalas, personal finance expert and founder of Savvy ,

“We see many people applying for loans who have never thought much about their credit score before. Some get a rude shock when they learn that this record follows you around and never really goes away."

"It’s worth checking up on your score a few years prior to applying for major finance, such as a mortgage for example. Several years out, you can do a lot to improve things, which will ultimately have a big impact on the interest rate and conditions of your loan - which equals savings for the entire loan period.”

My credit score just dropped – why?

Your credit score can drop for a number of reasons. This could be due to applying for too much credit too quickly – banks and lenders will think you are in financial distress and are taking out loans to cover other debts or bills.

You may have missed payments on loans or credit cards – even if you made an honest mistake, will still show up as “overdue” on your credit history. This is a “warning” to other lenders that you may not pay back their loans, if approved.

Defaulting is a major cause of credit score dips. A long-overdue bill or loan repayment may put you into default when a debt over $150 is over 60 days overdue. If you are in default, you would have been notified by mail, phone, or other means. A default can show up on your credit report for up to seven years.

Likewise, a “serious credit infringement” or clear-out, which means you owe money on a credit account but have vacated a last known address before paying it off can also be seen as equivalent to a default.

Comprehensive credit reporting also shows if you are close to your credit limit at any given month, if you’ve applied for credit limit increases, and whether you are paying your balance without delay. If you are skirting the line of your credit limit, increasing your limit, etc. consistently, it can decrease your score.

Unusually, paying off a big loan or closing a credit account may also contribute to a temporary fall in your credit score. This is because there is less credit in your name to report on – but your credit score will stabilise or even improve after a month or two.

Payment pauses or loan relief and credit scores

If you asked for a payment pause or temporary payment relief from your bank or lender during the COVID-19 pandemic and were approved, this will not negatively impact your credit score. If you continued paying your loan off as normal, your credit report will reflect that fact.

What can I do to improve my credit score?

There are many ways to improve your credit score if you haven’t had a great track record when it comes to your credit score.

The first, as mentioned, is to get a copy of your credit report and check for errors. You must correct them and provide evidence to show the entry on your file is a mistake. You should also watch for identity theft – as hackers and scammers can use personal information to take out credit in your name.

You should aim to pay off any outstanding debts – even if you are well behind on payments. Even a default will show up as resolved on your report – and any repayment is better than no repayment. You should also endeavour to pay your bills on time. Setting up direct debits is a good idea to avoid late payments. Try to shuffle these around so money comes out just after your pay or wages come in each period.

You should also try to limit new credit applications – especially while you have a bad credit score. If you can, wait until your score improves before applying for new credit.

Be wary of “credit washers” and “credit repair” companies – they can only fix credit listings that are factually incorrect; and something you can do yourself for free. A credit repair company claiming they can “scrub your credit history” should be looked upon with scepticism.

This information is general in nature and is not a substitute for financial advice from a licenced broker or adviser.

Nestegg.com.au - Best and Worst Credit Scores Australia

MoneySmart.com.au - Credit Scores and Credit Reports

ClearScore.com - Bad Credit Score

MyCreditFile.com.au - Understanding Your Equifax Credit Report

CreditSmart.org.au - CreditSmart Covid Communication Aug 2020 Payment Pause

ASIC.gov.au - Marketplace Lending Peer to Peer Lending Products

Did you find this page helpful?

Author

Adrian EdlingtonGuest Contributor

Bill TsouvalasPublished on March 1st, 2022

Last updated on March 18th, 2024

Fact checked

This guide provides general information and does not consider your individual needs, finances or objectives. We do not make any recommendation or suggestion about which product is best for you based on your specific situation and we do not compare all companies in the market, or all products offered by all companies. It’s always important to consider whether professional financial, legal or taxation advice is appropriate for you before choosing or purchasing a financial product.

The content on our website is produced by experts in the field of finance and reviewed as part of our editorial guidelines. We endeavour to keep all information across our site updated with accurate information.