- The Savvy Promise

At Savvy, our mission is to empower you to make informed financial choices. While we maintain stringent editorial standards, this article may include mentions of products offered by our partners. Here’s how we generate income.

In this article

As part of Savvy’s ongoing research into automotive consumer sentiment and broader financial landscape of Australians, we present the latest car finance statistics in Australia. Check back for new and updated statistics as they become available.

- Total registered motor vehicles reached 21.2 million by 31-Jan, 2023 – a 2.3% increase

- Toyota is the leading manufacturer of passenger vehicles for the 18th consecutive year

- Petrol-powered cars are 68.7% of registered motor vehicles, while diesel-powered are 28.3%

- EVs and BEV number surged significantly, compared to January 2022

- Hybrid electric vehicles (HEVs) saw approx. 362,700 units registered by Jan 2023: a 31% annual rise

Interested in buying a new car? Perhaps you’re looking to sell? One of the major indicators of consumer sentiment around automotive buying and selling are car loan commitments and new car sales.

If you are in the market for a car – or looking to sell, using car loan statistics can be a guide to when the market is flat or heating up for sellers. A greater volume of new car loans or fixed term personal loans for vehicles may indicate increased consumer confidence and demand.

Here is a comprehensive look at the latest car loans statistics – check this page regularly for up-to-date information as it becomes available.

New fixed term loan commitments for the purchase of road vehicles (seasonally adjusted, $b)

| Date | in AUD $ Billions |

|---|---|

| Jan-23 | 1.154 |

| Feb-23 | 1.158 |

| Mar-23 | 1.189 |

| Apr-23 | 1.215 |

| May-23 | 1.33 |

| Jun-23 | 1.308 |

| Jul-23 | 1.338 |

| Aug-23 | 1.416 |

| Sep-23 | 1.413 |

| Oct-23 | 1.433 |

| Nov-23 | 1.368 |

| Dec-23 | 1.301 |

Source: Australian Bureau of Statistics, Lending Indicators, December 2023.

Top sales by car brand

| Manufacturer | No. of Sales (March 2024) |

|---|---|

| Toyota | 18,961 |

| Ford | 8,776 |

| Mazda | 8,246 |

| Mitsubishi | 7,866 |

| Kia | 7,070 |

No Data Found

Source: Federal Chamber of Automotive Industries (FCAI), VFACTS National Report, New Vehicle Sales, March 2024, pg. 3.

| Month | YTD | |||

| 2024 | 2023 | 2024 | 2023 | |

| A.C.T. | 1,584 | 1,576 | 4,617 | 4,384 |

| N.S.W. | 33,808 | 30,256 | 92,542 | 84,340 |

| N.T. | 930 | 776 | 2,543 | 2,166 |

| Qld. | 23,550 | 22,244 | 65,802 | 59,437 |

| S.A. | 6,992 | 6,543 | 19,442 | 17,878 |

| Tas. | 1,610 | 1,620 | 4,920 | 4,584 |

| Vic. | 30,099 | 24,107 | 82,284 | 68,368 |

| W.A. | 11,074 | 10,129 | 32,302 | 27,845 |

| Total | 109,647 | 97,251 | 304,452 | 269,002 |

Source: Federal Chamber of Automotive Industries (FCAI), VFACTS National Report, New Vehicle Sales, March 2024, pg. 1.

| March | YTD | |||

| 2024 | 2023 | 2024 | 2023 | |

| Passenger | 17,611 | 17,182 | 53,655 | 50,219 |

| SUV | 64,631 | 53,526 | 172,234 | 148,112 |

| Light Commercial | 23,061 | 22,012 | 67,427 | 59,308 |

| Heavy Commercial | 4,344 | 4,531 | 11,136 | 11,363 |

| Total Market | 109,647 | 97,251 | 304,452 | 269,002 |

Source: Federal Chamber of Automotive Industries (FCAI), VFACTS National Report, New Vehicle Sales, March 2024, pg. 2.

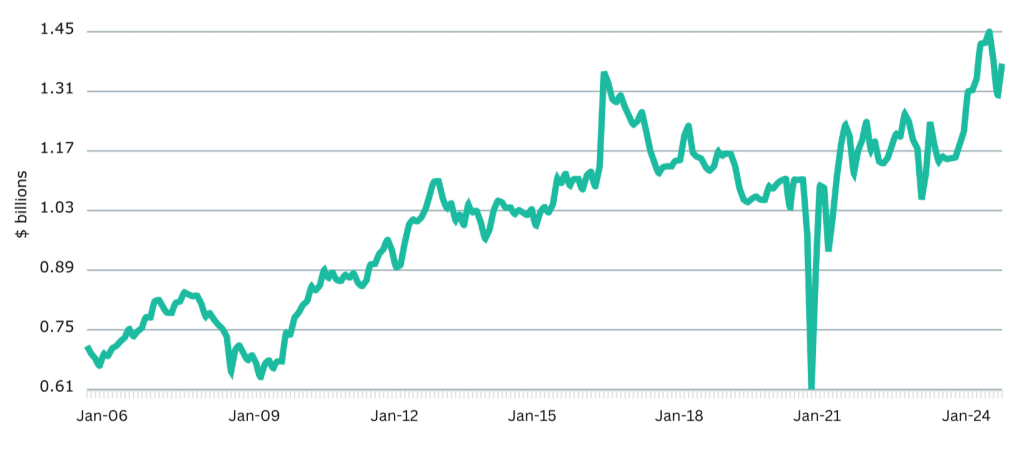

What is the total value of new car loans in Australia?

According to the lending indicators from the Australian Bureau of Statistics (ABS), the monthly value of new fixed-term loan commitments taken out to purchase a road vehicle totalled over $15.6 billion across 2023.

The lowest value across any month that year was $1.154 billion, recorded in January, while the peak was reached in October at $1.433 billion. This peak was the highest monthly value ever recorded by the ABS for fixed-term vehicle loans, ahead of the $1.355 billion seen in March 2016. August ($1.416 billion), September ($1.413 billion) and November ($1.368 billion) of 2023 all also passed this benchmark.

In terms of overall value, 2023 registered the greatest annual total on record, comfortably beating out the previous best of just over $15 billion from 2016. This number increased by upwards of $1.5 billion compared to 2022 (approx. $14.1 billion) and was as low as around $12.3 billion as recently as 2020 during the pandemic.

Purchase of road vehicles in Australia (2006-2024)

Source: ABS.gov.au, Statistics, Lending indicators, January 2024.

New car sales Australia: March 2024

According to the Federal Chamber of Automotive Industries, Australia’s peak body for the broader vehicle industry, March 2024 saw total new vehicle sales hit 109,647, an increase of 12.7% over the same period last year (March 2023).

Sports Utility Vehicles (SUVs) remained the most popular class of passenger vehicle, with their market share swelling to 58.9% of sales. Light Commercial sales stood at 21.0%, while other passenger vehicles comprised 16.1% of sales.

The total number of electric, hybrid and plug-in hybrid electric (PHEV) sales across March accounted for just under a quarter (23.5%) of all new vehicles registered throughout the month.

What is the average purchase price of a car in Australia?

According to Drive, the average transaction price for new cars in Australia in 2022 sat at $50,161, which was an increase of 42.5% on the same figure from ten years prior ($35,200). It's important to note, though, that the automotive industry was in the midst of pandemic-affected stock shortages and production issues at that time.

However, a report by Cox Automotive Australia found that the cost of used vehicle sales declined throughout the fourth quarter of 2023. Dealer retail used car prices were 8.9% lower by the end of December compared to February 2023 and 9.8% lower than the recorded peak in August 2022.

While the prices of passenger cars and SUVs were notably higher than the reference period of December 2019 (44.7% and 27.1%), battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) only rose by 5.9%. This, notes the report, suggests more affordable electrified vehicles are available on the market today, while segments like passenger cars may be experiencing undersupply and overpayment as a result.

What are the average car loan repayments around Australia and by city?

The average Australian living in a capital city spends $190.23 per week and $9,892 per year on their car loan, as revealed by Australian Automobile Association (AAA) data from Q4 2023.

These numbers climbed significantly compared to those recorded in Q4 2022, which sat at $155.93 per week and $8,108 per year. This means that the cost of car loans for those living in our capital cities has increased by 22% over the 12 months leading up to Q4 2023.

In terms of cities, Perth was at the top of the list for car loan costs with $10,020 per year being spent per household, which was followed by Sydney ($9,937) and Melbourne ($9,913). Brisbane households spent the least on their car loans at $9,818, which beat out Hobart ($9,835) and Darwin ($9,845).

The figures recorded for regional centres were almost identical, with the weekly and monthly averages in Q4 2023 sitting at $190.19 and $9,890, respectively.

Average of Australian capital city car loan payments per quarter (2020 - 2023)

No Data Found

Source: AAA, Data Reports, Transport Affordability, 3 – Comparing Transport Category Costs Over Time, Per household

How many car loans are in arrears in Australia?

A car loan in arrears means there is at least some part of the loan which is overdue following the passing of the payment due date. According to Equifax’s Quarterly Consumer Credit Report from Q4 2023, 1.25% of car loans are between one and 29 days past due (DPD), 1.39% are between 30 and 89 DPD and 0.90% are 90 or more DPD, meaning approximately 3.5% of all car loans are in arrears.

The proportion of loans 90+ DPD decreased by 0.04% compared to the equivalent quarter the year prior (Q4 2022), while those 1-29 DPD fell by 0.10%. However, loans in the 30-89 DPD bracket increased by 0.03% in that time.

The numbers from Q4 2023 also represent notable decreases compared to Q2 2023, where the brackets sat at 1.55% for 1-29 DPD, 1.60% for 30-89 DPD and 1.17% for 90+ DPD, totalling 4.32%.

Equifax Auto Loan Arrears - 2023 (vs Same Quarter 2022)

No Data Found

Source: Equifax, Quarterly Consumer Credit Insights Report, Q4, 2023, pg 12.

New car sales per state and territory: March 2024

Compared to the same period last year, sales increased in Victoria (24.9%), the Northern Territory (19.8%), New South Wales (11.7%), Western Australia (9.3%), South Australia (6.9%), Queensland (5.9%) and the ACT (0.5%) in March. The only state or territory whose sales decreased was Tasmania (-0.6%).

According to the Federal Chamber of Automotive Industries (FCAI),

“Records for new vehicle sales continue to be broken with the March result of 109,647 surpassing the previous March record of 106,988 which was achieved in 2018.”

Used car statistics in Australia

The average price for a used car in Australia during 2022 was $37,000 – a $10,000 increase over 2020 due to rising interest rates, stretched supply chains, and general headline inflation. January 2023 saw a 2.1% dip in prices – the first ease in prices since record highs during May 2020. Economists predict a further 10% easing in prices during 2023-2024 as the economy rebounds, supply chains are restored, and stability returns to the marketplace.

Electric vehicle statistics in Australia

According to the Electric Vehicle Council, 46,624 electric vehicles (EVs) were sold in Australia the year to date June 2023 – more than all EVs sold in the entirety of 2022.

8.4% of new cars sold are EVs (June 2023), a 121% increase over 2022. 30% of all electric vehicles sold were manufactured by Tesla.

There are over 148 variants and 91 models of EVs available in Australia for purchase, which include 32 PHEVs and 59 Batter EVs. There are 22 Electric buses available, 12 different electric trucks, and 42 models of electric motorcycles and scooters.

The EVC estimates there are approximately 130,000 EVs on Australian roads, comprised of 109,000 BEVs and 21,000 PHEVs.

Around Australia, there are 967 high-power public chargers in 558 locations around Australia. There are 438 fast charger (24-99kW) locations and 120 ultra-fast charger (100kW+) locations, a 57% increase over 2022.

Top five EV models sold 2023

| Model | Sales |

|---|---|

| Tesla Model Y | 14,002 |

| Tesla Model 3 | 11,575 |

| BYD Atto 3 | 6,196 |

| MG ZS EV | 1,787 |

| Volvo XC 40 | 1,596 |

Source: Electric Vehicle Council, State of EVs, 2023

Key car statistics in Australia

According to the Australian Bureau of Statistics Transport Census (June 2022) 91.3% of households reported they had at least one registered vehicle and 55.1% said they had more than two. This means 673,969 Australian households do not own at least one car.

52.7% of Australians drove their cars or vehicles to work, making them the most popular conveyance in each State and Territory. This excludes motorbikes, motor scooters, and heavy vehicles.

The average age of an Australian car is approximately 9.9 years of age. Tasmanians hold on to their cars the longest (12.6 years) while Northern Territorians change their cars the most often (9.1 years.)

Average car running costs

| Vehicle Category | Average Monthly Cost | Average Annual Cost |

|---|---|---|

| Light cars | $857.16 | $10,285.92 |

| Small cars | $1,063.64 | $12,763.70 |

| Medium cars | $1,362.69 | $16,352.26 |

| People movers | $1,575.87 | $18,910.45 |

| Electric | $1,541.32 | $18,495.83 |

| SUV small | $1,021.52 | $12,258.23 |

| SUV medium | $1,345.07 | $16,140.82 |

| SUV large | $1,620.42 | $19,445.04 |

| All terrain | $2,048.40 | $24,580.74 |

Source: RACV, Car Running Costs, 2022, pg. 2.

Road fatalities in Australia

According to the Australian Road Deaths Database, part of the Bureau of Infrastructure and Transport Research (BITRE) there were 1,266 road deaths for the last 12 months to December 2023.

The ACT saw a 77.8% decrease in road fatalities over 2022, followed by the NT with a 34% decrease and Tasmania with 33% decrease. Western Australia had a 9.7% decrease; QLD a 6.7% decrease.

Victoria saw a 22.5% increase over the previous year; NSW road fatalities increased by 24.9%, and South Australian road fatalities spiked by almost two thirds (64.8%).

The demographic with the highest proportion of road fatalities was the 40 to 64s, with 387 deaths, followed by the 26 to 39s at 281 and the 17 to 25s at 244.

How much do cars cost to run in Australia?

According to a 2022 survey conducted by the RACV, all-terrain vehicles had an average annual cost of $24,580.74 to run, while light cars such as sub-compact or hatchback vehicles were the cheapest at an average annual cost of $10,285.92. This includes loan repayments (average), registration, fuel, servicing, and tyres.

Electric vehicles loan component was the largest contributor to running costs. For a direct comparison on fuel costs, the Hyundai Ioniq 5 2WD only required $84.63 in “fuel” costs per month, while the equivalent Internal Combustion Engine vehicle (ICE), the Hyundai Kona 2.0L 2WD CVT model consumed $148.57 in fuel per month.

According to the Australian Automobile Association, 16.3% of Australians income is spent on transport costs per week (Q3 2023), a 0.5% increase since Q2 2023. This represents $22,462 spent on transport per year.

The average cost per household per week is $466.57 or 16.9% of income in capital cities, and $392.39 or 15.7% of income in regional centres.

The average spent on insurance per week was $42.67 in capital cities and $35.02 in regional centres.

Capital city toll expenses averaged to $67.87, with Sydney weighing in at the top of the table at $83.02.

Registration costs per state

| State | Estimated Annual Costs | Sydney | $1,318 |

|---|---|

| Melb. | $1,798 |

| Adelaide | $1,434 |

| Hobart | $1,236 |

| Perth | $1,854 |

| Darwin | $1,700 |

| Canberra | $2,175 |

| Brisbane | $1,666 |

Source: AAA.asn.au, Transport Affordability

Registration costs per state

However, some states split registration costs into two portions: the CTP (Compulsory Third Party insurance, or green slip) and the vehicle registration component. In NSW, QLD, and SA, one may buy CTP insurance from a market-based provider. As such, CTP costs may vary depending on the age and class of your vehicle.

Each state has their own methods of calculating yearly (or periodic) registration costs. While NT charges based on engine size regardless of the number of cylinders in the car, WA and NSW charge registration based on weight, Queensland and Tasmania charge depending on cylinders.

Registered Vehicles by State/ Territory, 2021, 22 & 23

No Data Found

Source: RACV, Car Running Costs Survey, 2022.

Road fatalities in Australia

According to the Australian Road Deaths Database, part of the Bureau of Infrastructure and Transport Research (BITRE) there were 1,266 road deaths for the last 12 months to December 2023.

The ACT saw a 77.8% decrease in road fatalities over 2022, followed by the NT with a 34% decrease and Tasmania with 33% decrease. Western Australia had a 9.7% decrease; QLD a 6.7% decrease.

Victoria saw a 22.5% increase over the previous year; NSW road fatalities increased by 24.9%, and South Australian road fatalities spiked by almost two thirds (64.8%).

The demographic with the highest proportion of road fatalities was the 40 to 64s, with 387 deaths, followed by the 26 to 39s at 281 and the 17 to 25s at 244.

Road Fatalities in Australia

| Road User | Proportion |

|---|---|

| Driver | 48% |

| Motorcyclist | 20.1% |

| Passenger | 16% |

| Pedestrian | 12.5% |

| Cyclist | 2.8% |

Source: BITRE, Fatal Road Crash Database.

How many cars are there in Australia?

On January 31, 2023, the total number of registered motor vehicles reached 21.2 million, marking a rise of about 2.3 percent compared to the preceding year. Additionally, an estimated 4.7 million units of caravans, trailers, and various equipment types such as construction vehicles and all-terrain vehicles were registered, not included in the aforementioned total.

The number of registered battery and fuel-cell electric vehicles (BEVs and FCEVs) surged to approximately 79,700 units, reflecting a remarkable increase of over 100 percent compared to January 2022. Within this segment, battery and fuel-cell electric passenger cars comprised 72,248 units, accounting for roughly 0.5 percent of all registered passenger vehicles in 2023, marking a significant 114 percent surge from the previous year.

Hybrid electric vehicles (HEVs) also experienced a notable uptick, with approximately 362,700 units registered by January 31, 2023, reflecting a 31 percent rise compared to January 2022. Of these, hybrid electric passenger vehicles numbered 361,580, representing about 2.4 percent of all registered passenger vehicles.

Age of vehicles in Australia

The average age of vehicles across Australia witnessed a slight increase from approximately 11.0 years in 2022 to around 11.3 years in 2023, with passenger vehicles showing a similar trend from around 10.8 years in 2022 to 11.0 years in 2023. Rigid trucks saw a 4.3 percent increase in registrations, totalling approximately 574,600 units by January 31, 2023, while articulated trucks experienced a 4.1 percent rise, reaching around 120,300 units.

The number of registered caravans climbed by approximately 5.3 percent to 765,150 units by January 31, 2023, compared to the end of January 2022. Likewise, registered trailers saw a rise of about 1.8 percent, totalling approximately 3.61 million units by January 31, 2023, compared to the end of January 2022.

Source: BITRE, Road Vehicles, Australia, January 2023, pg.1

- Australian Bureau of Statistics, Lending indicators, December 2023

- Federal Chamber of Automotive Industries, News Releases, 06 Feb 2024

- Electric Vehicle Council, State of EVs, 2023

- Australian Bureau of Statistics, Transport Census, 28 June 2022

- Australian Automobile Association, Transport Affordability Dashboard, Q3 2023

- RACV, Car Running Costs 2022

- Australian Road Deaths Database (ARDD), January 2024

- Equifax, Quarterly Consumer Credit Insights Report Q4, 2023, pg 12

Did you find this page helpful?

Author

Adrian EdlingtonReviewer

Bill TsouvalasPublished on February 14th, 2024

Last updated on May 10th, 2024

Fact checked

This guide provides general information and does not consider your individual needs, finances or objectives. We do not make any recommendation or suggestion about which product is best for you based on your specific situation and we do not compare all companies in the market, or all products offered by all companies. It’s always important to consider whether professional financial, legal or taxation advice is appropriate for you before choosing or purchasing a financial product.

The content on our website is produced by experts in the field of finance and reviewed as part of our editorial guidelines. We endeavour to keep all information across our site updated with accurate information.

Approval for car loans is always subject to our lender’s terms, conditions and qualification criteria. Lenders will undertake a credit check in line with responsible lending obligations to help determine whether you’re in a position to take on the loan you’re applying for.

The interest rate, comparison rate, fees and monthly repayments will depend on factors specific to your profile, such as your financial situation, as well others, such as the loan’s size and your chosen repayment term. Costs such as broker fees, redraw fees or early repayment fees, and cost savings such as fee waivers, aren’t included in the comparison rate but may influence the cost of the loan. Different terms, fees or other loan amounts may result in a different comparison rate.