- The Savvy Promise

At Savvy, our mission is to empower you to make informed financial choices. While we maintain stringent editorial standards, this article may include mentions of products offered by our partners. Here’s how we generate income.

In this article

As part of Savvy’s ongoing research into consumer behaviour and economic wellbeing, we take a look at spending habits of Australians around the “Black Friday” and “Cyber Monday” pre-Christmas sales.

- 59% of Aussies going to spend on clothes and shoes; 35% on electronics

- 51% say they won’t be spending as much this festive season as they did last year

- 56% are likely to spend $500 or less

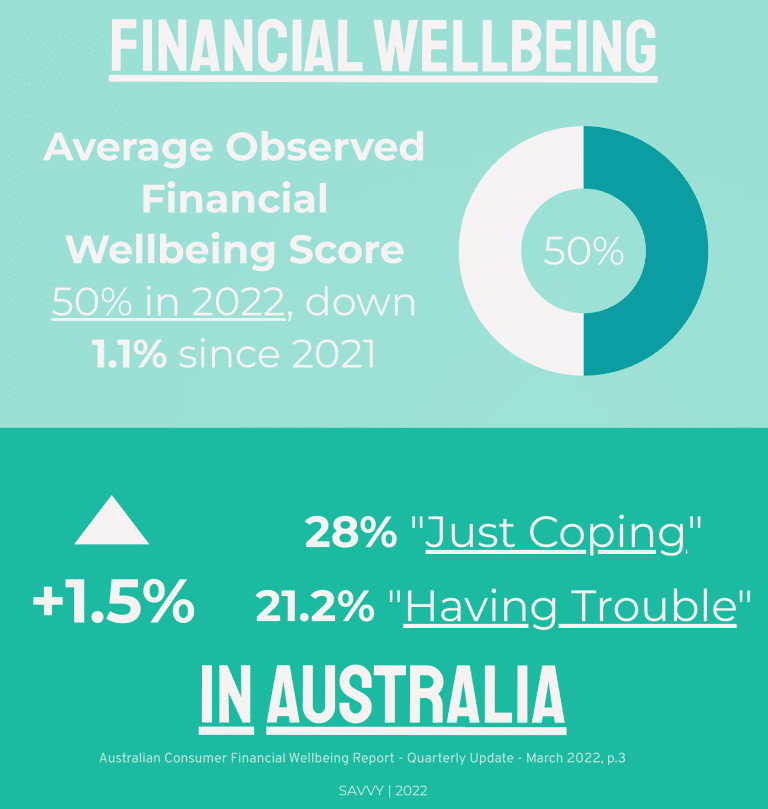

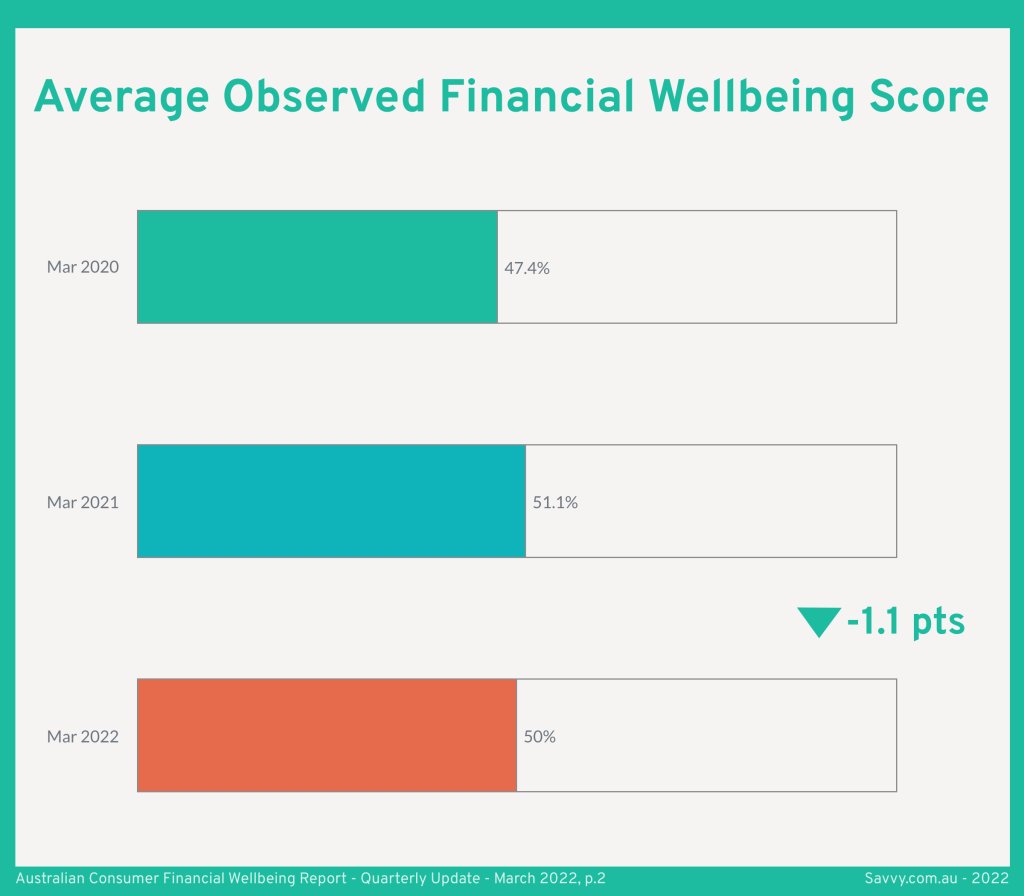

Do you feel secure with your finances? Do you feel more well off than last year? Despite inflation hovering above 7.1% and interest rates climbing seemingly every month, the latest research by the Commonwealth Bank and University of Melbourne’s Melbourne Institute showed that the overall financial wellbeing in Australia decreased by 1.1 points to 50 points out of a possible 100. (Below 50 means more people are worse off than better off, and vice versa.)

This is a 2.6-point increase over March 2020, which was at the height of uncertainty surrounding the COVID-19 pandemic.

Though high-level average statistics may look pleasing, the nitty gritty holds real answers. What do the metrics tell us, and does it bode well for financial wellbeing in the future?

Distribution of financial wellbeing

Financial wellbeing in this report is calculated using five different metrics. Respondents were asked whether:

- If they experienced payment problems in the last year

- If a customer had the ability to cover usual monthly expenses

- How many months they experienced where expenditure exceeded income by 80%

- The number of days where a respondent had the ability to raise one- or six-months’ expenses from available savings or credit

- About level of savings relative to other people of the respondent’s age.

Respondents answer on a scale of 0 to 5, with 0 being the worst possible outcome and 5 being the best possible outcome.

According to the report, there are four categories of financial wellbeing. “Doing Great”, “Getting By”, “Just Coping”, and “Having Trouble”. The categories of “Just Coping” and “Having Trouble” increased by 1.5 points over March 2021 and March 2022. The “Doing Great” category dropped by half a point and “Getting By” shrank by one point.

The average observed financial wellbeing score showed a decrease of 1.1 points over last year, though 2.6 points higher than two years earlier at the start of the pandemic. It also showed that savings levels improved, with median savings balances 46% higher than pre-pandemic levels.

Changes in median Australians’ finances

The report tracked the incomes and outgoings of Australians around the country. Combined with Australian Bureau of Statistics data, incomes and inflows (non-work income) remained the same as March 2021.

Savings balances also saw the same number as last year. The precautionary savings metric, however, kept last year’s score of 50 high, as many people saved more “just in case” government interventions such as JobSeeker or JobKeeper stopped. However, this cautious optimism that underpinned 2021 has faded somewhat in 2022, as inflation and high interest rates cause greater economic uncertainty.

Perhaps due to life returning to normal and higher inflation (or a combination thereof), outflows and expenditures rose by $1,600. This may reflect the jump in monthly rent or mortgage repayments as well as the overall higher cost of living due to higher priced petrol, gas, groceries, and electricity.

Changes in Australians experiencing problems with finances

Even though there is an overall increase in wellbeing, the change in proportion of Australians experiencing problematic financial outcomes has also risen slightly.

There was a six-point increase in the number of Australians who are consistently spending at high levels, defined as over 80% of their income in the survey, which damage their capacity for regular saving.

There was no change in the proportion who are experiencing severe payment problems, which is defined by being behind in bills, rent, or mortgage repayments for more than two months out of the last twelve. This also means compounding payment issues such as late fees, dishonour fees, and over-limit fees.

There was a two-point increase in Australians living paycheque to paycheque and the proportion of Australians that didn’t have adequate rainy-day savings. The latter is defined by an inability to raise at least one month’s worth of expenses from savings or credit on hand for at least three-quarters of the past year.

There was a one-point increase in the proportion of Australians holding below average savings, defined as “more than one standard deviation below the median for their age bracket.”

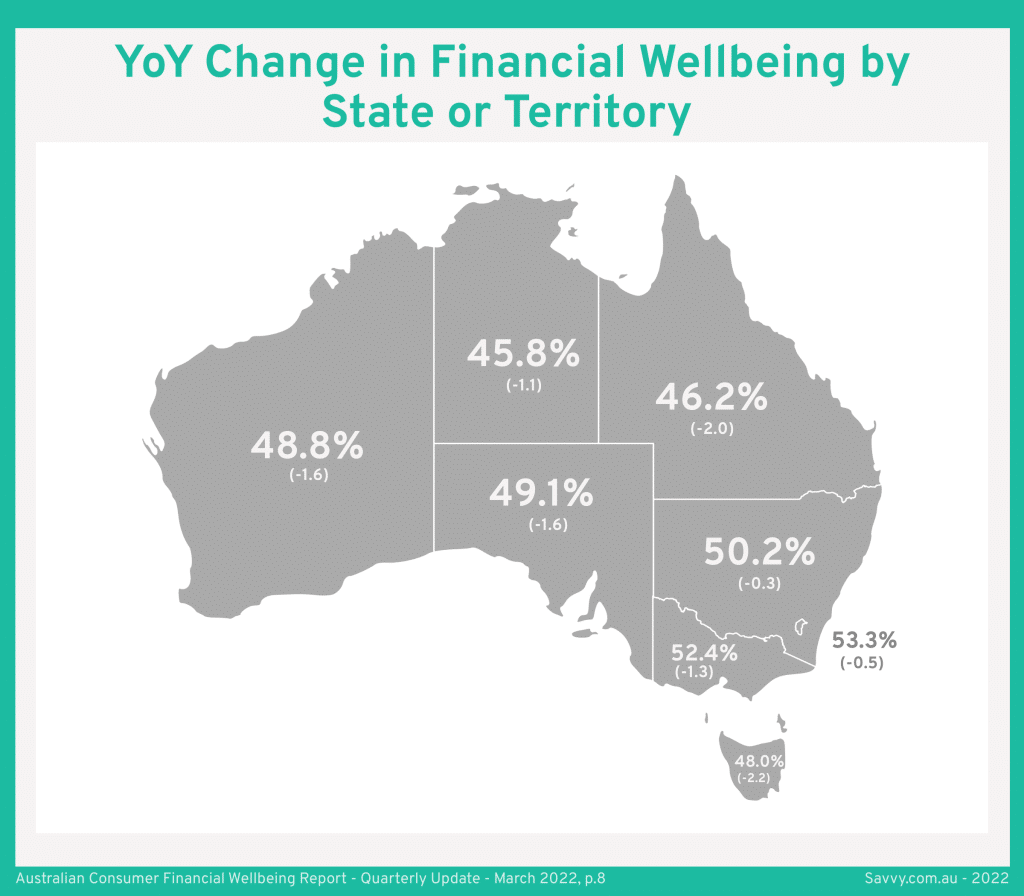

Year on year change in financial wellbeing by location

The highest average levels of financial wellbeing in Australia were found in the ACT (53.3pts) and Victoria (52.4pts). The lowest levels were found in the NT (45.8pts) and Queensland (46.2pts).

The largest decreases year on year were found in Tasmania (-2.2pts to 48pts) and Queensland (-2pts.) In fact, all states and territories recorded overall decreases.

The decline, according to the report, can be chalked up to outflows and expenditures increasing due to pent-up demand; though as inflation has bitten harder, consumer sentiment has worsened.

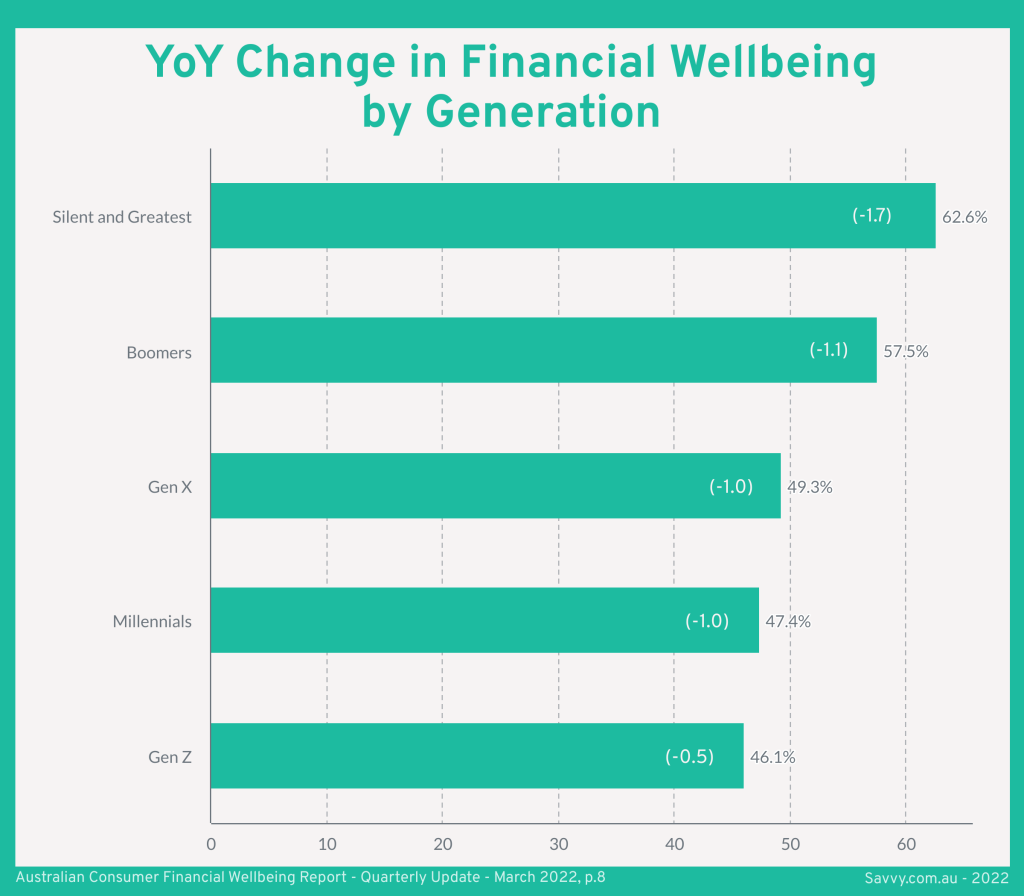

Year on year change in financial wellbeing by generation

Financial wellbeing decreased across all age brackets between March 2021 and March 2022, with the Australians from the “Silent” and “Greatest” generations experiencing the most precipitous fall with a 1.7pt decrease. The Baby Boomers were next on -1.1pts, followed by Generation X and Y (Millennials) losing a point each. Generation Z’s wellbeing dropped by half a point.

Getting on top of financial wellbeing

With an overall increase in Australian consumers “having trouble” or “just coping” and perhaps living paycheque to paycheque, getting on top of financial wellbeing can be remedied with a bit of financial planning.

Savvy Spokesperson, Adrian Edlington;

“Though the good old days of near zero interest rates are over, people who are struggling to make ends meet may be hampered by paying ongoing high-interest debts such as credit cards,” says Savvy spokesperson and financial expert Adrian Edlington.

“One way to wrangle debts is to create a snapshot of your income and spending, set a strict budget, and consider consolidating debts using a personal loan. This allows households to ease some of the pressure of debt and put them on a path to debt freedom, saving more, and greater financial wellbeing.”

Did you find this page helpful?

Author

Adrian EdlingtonGuest Contributor

Bill TsouvalasPublished on November 17th, 2022

Last updated on March 15th, 2024

Fact checked

This guide provides general information and does not consider your individual needs, finances or objectives. We do not make any recommendation or suggestion about which product is best for you based on your specific situation and we do not compare all companies in the market, or all products offered by all companies. It’s always important to consider whether professional financial, legal or taxation advice is appropriate for you before choosing or purchasing a financial product.

The content on our website is produced by experts in the field of finance and reviewed as part of our editorial guidelines. We endeavour to keep all information across our site updated with accurate information.