- The Savvy Promise

At Savvy, our mission is to empower you to make informed financial choices. While we maintain stringent editorial standards, this article may include mentions of products offered by our partners. Here’s how we generate income.

In this article

As part of Savvy’s ongoing research into the personal finance habits of Australians, we survey Australian adults about their plans to pay off large Christmas expenses and how they’ll keep on top of finances in 2023.

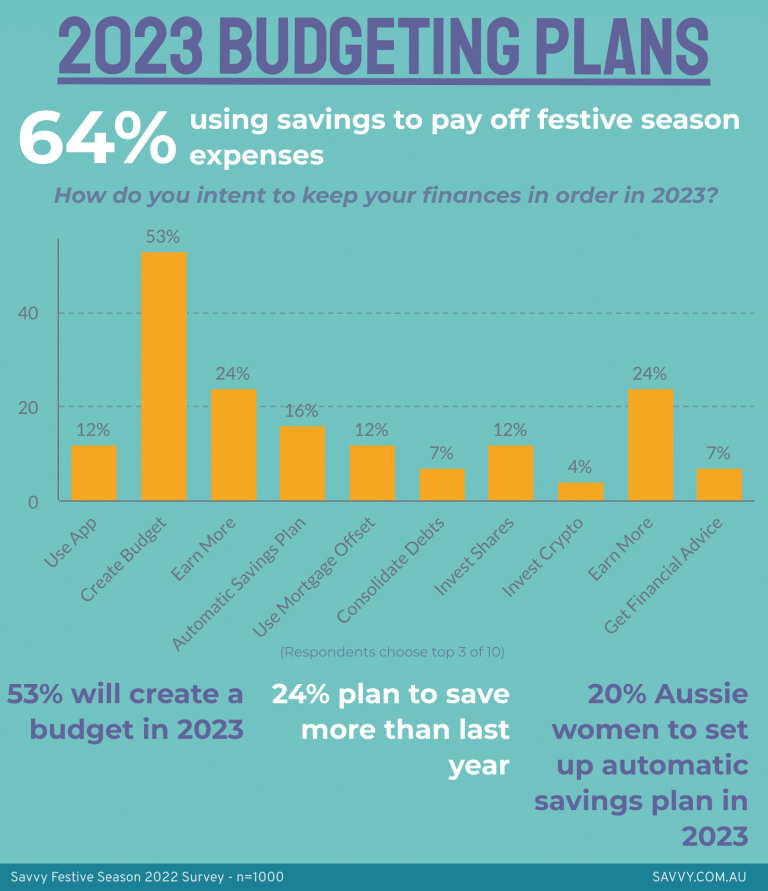

- 64% of Australians will use existing savings to pay off Christmas expenses; only 14% will use the credit card

- 53% of Australians say they’ll create a budget to keep on top of finances in 2023 – comprising 62% of women

- 24% of Australians intend to save more money than last year

- 20% of Australian women will set up an automated savings plan during 2023

A representative survey of 1,000 Australians about how they’ll avoid financial stress in 2023 has shown that a little over a half of those polled (53%) say they’ll create a budget to keep their finances in order.

62% of women said they would create a budget; while the 25-34 and 35-44-year-old demographics said they would be the most likely to create a budget (65% and 62% respectively.)

12% of Australians (9% of men and 14% of women) said they’d use a budgeting app; 7% said they would consult a financial planner or adviser.

16% of Australians – 12% of men and 20% of women – said they would set up an automated savings plan, such as direct debit to a savings account or managed fund.

Interestingly, a shade under a quarter (24%) of Australians said they’d simply “earn more money than last year.” For the most optimistic demographic, 18-24s (36%) this may prove a winning strategy as the older part of the cohort enter more senior positions.

12% would pay more into a mortgage offset account; 16% would make investments (12% into shares, 4% into cryptocurrency.)

Overcoming Christmas Financial Hangover

Many people in Australia spent up big over Christmas, with the Australian Retailers’ Association showing pre-Christmas sales in excess of $74.5 billion, up 8.6% over last year.

As for how Australians are planning to pay off their Christmas expenses, the overwhelming majority (64%) said they would be using their savings.

25% said they would use income from their paycheque, while only 14% said they’d rely on the credit card.

How are you mainly planning to pay off your Christmas expenses and avoid financial stress in the new year?

No Data Found

(Respondents choose top 3)

By age group

| Preference by Age-group | 18 - 24 years | 25 - 34 years | 35 - 44 years | 45 - 54 years | 55 - 64 years | 65+ |

|---|---|---|---|---|---|---|

| Use existing savings | 68% | 70% | 66% | 56% | 60% | 64% |

| Income from paycheque | 38% | 32% | 33% | 26% | 17% | 9% |

| Use credit card | 12% | 13% | 13% | 16% | 16% | 13% |

| Borrow money from friends / family | 4% | 1% | - | 3% | 2% | - |

| Take out a loan / consolidate debts | - | 2% | 2% | - | 1% | - |

| Not relevant to me | 11% | 12% | 9% | 14% | 18% | 22% |

| Other | 2% | 1% | 3% | 5% | 3% | 2% |

(Respondents choose top 3)

Savvy Spokesperson, Adrian Edlington;

Adrian says that inflation and higher interest rates have given people a “crash course” on managing their personal finances better.

“Over the last couple of years, Australians have had to really pay attention to every dollar that comes in and out of the household, and people are making more responsible choices with their finances as a result,” he says.

“In our last survey, 76% Australians said they’d only use their savings to fund their Boxing Day purchases if they were buying post-Christmas and 48% said they wouldn’t be making any purchases at all.

“7% said they would consolidate debts, which is pleasing to see – reducing debts and the interest paid on them will mean more money for savings and better overall financial health for households.

“This could all indicate Australians are beginning to spend only within their means, so they could be better prepared for whatever economic ups and downs may eventuate during 2023.”

Savvy, Festive Season 2022 survey, (n=1000)

Nationally representative survey of 1000 adult Australians, aged 18 and over. Conducted by Octopus Group, on behalf of Savvy.

Completion date: 2/12/2022

Age groups:18-24, 25-34, 35-44, 45-54, 55-64, 65+

Gender breakdown: male n=503, female n=495, non-binary /prefer not to say n=2

Representative of state and territory populations:

NSW n=299 (32.3%), Vic n=253 (25.1%), Qld n=196 (20.2%), SA n=82 (7.2%), WA n=114 (10.6%) NT n=12 (0.7%), Tas n=25 (2.2%), ACT n=19 (1.7%)

Did you find this page helpful?

Author

Adrian EdlingtonPublished on January 12th, 2023

Last updated on March 15th, 2024

Fact checked

This guide provides general information and does not consider your individual needs, finances or objectives. We do not make any recommendation or suggestion about which product is best for you based on your specific situation and we do not compare all companies in the market, or all products offered by all companies. It’s always important to consider whether professional financial, legal or taxation advice is appropriate for you before choosing or purchasing a financial product.

The content on our website is produced by experts in the field of finance and reviewed as part of our editorial guidelines. We endeavour to keep all information across our site updated with accurate information.