- The Savvy Promise

At Savvy, our mission is to empower you to make informed financial choices. While we maintain stringent editorial standards, this article may include mentions of products offered by our partners. Here’s how we generate income.

In this article

Savvy's second 2022 cost of living survey, of 1003 Australians, learns what impact inflation and higher prices are having at the checkout.

- 33% of those surveyed said their grocery bills have increased by between 11-20%

- Average cost of a grocery shop estimated at $168.50

- 21% of women say their grocery bill has increased by between 21-30%

- Prices set to rise again on 27th of July

Another survey on the cost of living commissioned by Savvy has revealed that half of Australians are paying between 11 and 30% more for their groceries since the start of 2022.

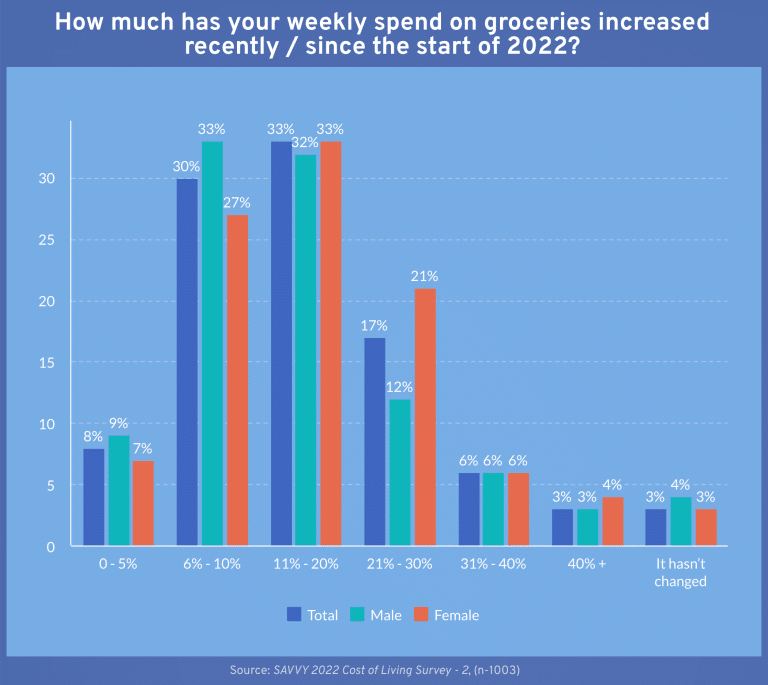

The survey of 1,003 respondents showed that 30% of participants said the cost of their grocery shop has increased by 6-10% since the beginning of this year.

33% say that their grocery bills have increased by 11-20%, while 17% say that their bills have surged by a whopping 21-30%.

21% of women say their grocery shop has increased by between 21%-30%, while only 12% of men reported the same.

The average cost of a weekly grocery shop, when meat, vegetables, dairy, bakery, frozen foods, beverages, and staples such as rice and flour are considered, is $168.50; rising to $189.10 when alcohol is added to the mix.

Grocery prices have surged amid a general 5.1% inflation in the economy.

Some fruits and vegetable prices have skyrocketed due to a “perfect storm” of low planting rates and frosty temperatures. Heads of iceberg lettuce have been seen to sell for $11.99 – well above the $2.80 average.

The peak body for Australian produce, AUSVEG says that fruit and vegetable prices have more than doubled due to a similar uptick in the costs of production.

Price pain to persist

Prices are set to rise once again from 27th July, prompted by a 50 point inflation rate rise due this week, according to Daily Mail Australia.

This is due to an unprecedented level of price rise requests – five times the usual rate – from suppliers, according to Coles Group CEO Steven Cain, as told to the Australian.

Pressure on Australian families is only set to grow as the RBA increased the official cash rate by 0.5%p.a to 1.35%p.a this Tuesday.

Economists have indicated that the cash rate will likely hover around 2.5%p.a. by the end of this year.

More than one million Australians are relying on Foodbank services to feed their families, according to The New Daily.

Bill Tsouvalas, Savvy Managing Director & personal finance expert;

“These are families with jobs – and they are struggling to get food on the table,” says Bill Tsouvalas, CEO of Savvy. “With so many people saying that their grocery bills are rising, the most vulnerable among us no longer have food security. This is unprecedented in a so called ‘bread basket’ country such as ours. The worry is that Australians are taking on higher levels of unsustainable debt in the form of payday loans or credit cards, which only serves to kick the can down the road. It’s not a long-term solution. For some, a sensible option would be to consider a debt consolidation loan.”

If you are experiencing acute mental stress due to finances, contact Beyond Blue on 1300 22 4636 or Lifeline on 131 114.

Savvy - 2022 Cost of Living Survey - 2 (n = 1003)

Sources:

ABS.gov.au - Mortgage Affordability Indicator - MAID

Dailymail.co.uk - Coles-Woolworths-set-increase-prices-days-Daily-Mail-Australia-exposed-prices

News.com.au/finance/rba-expected-to-lift-interest-rates-by-half-a-per-cent

Did you find this page helpful?

Author

Adrian EdlingtonGuest Contributor

Bill TsouvalasPublished on July 6th, 2022

Last updated on March 18th, 2024

Fact checked

This guide provides general information and does not consider your individual needs, finances or objectives. We do not make any recommendation or suggestion about which product is best for you based on your specific situation and we do not compare all companies in the market, or all products offered by all companies. It’s always important to consider whether professional financial, legal or taxation advice is appropriate for you before choosing or purchasing a financial product.

The content on our website is produced by experts in the field of finance and reviewed as part of our editorial guidelines. We endeavour to keep all information across our site updated with accurate information.