- The Savvy Promise

At Savvy, our mission is to empower you to make informed financial choices. While we maintain stringent editorial standards, this article may include mentions of products offered by our partners. Here’s how we generate income.

In this article

Savvy’s new personal finance survey of 1002 Australians discovers people's average monthly savings, where they put their money and how they feel about inflation.

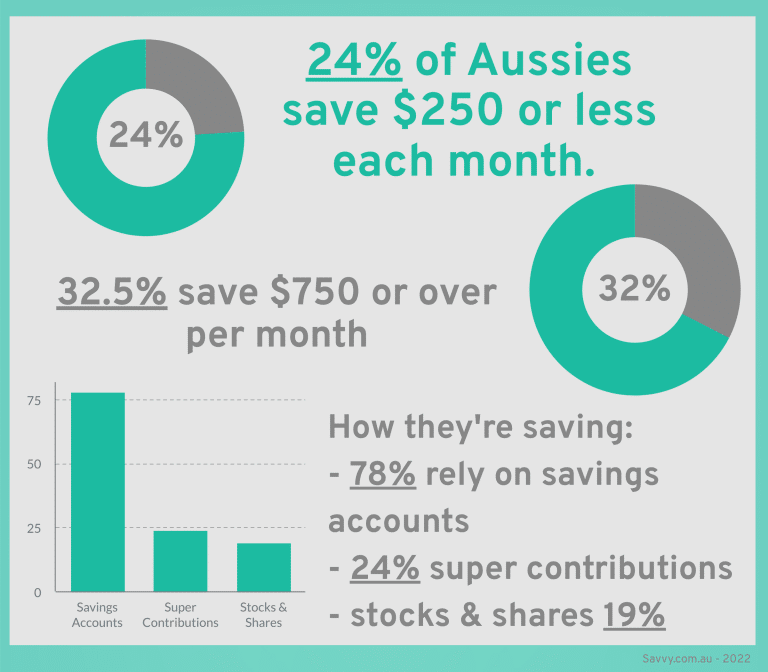

- 24% of Aussies save $250 or less each month

- 32.5% save $750 or over per month

- 78% rely on savings accounts, followed by super contributions (24%), then stocks & shares (19%)

- 21% of Australians “not confident at all” investment returns will continue to outpace inflation

A new survey commissioned by Savvy into the savings and investment habits of Australians (n=1,002) shows that saving rates among significant portions of the population are low, with 19% reporting that they did not save any money regularly.

How much are Australians saving?

24% of respondents said they saved at least $250 per month, with 15% saying they save between $251 and $500. More than 32% responded that they were saving over $750 a month, however.

Bill Tsouvalas, Savvy Managing Director;

Bill Tsouvalas, Savvy’s resident money expert, says that even in times of rising cost of living, paying oneself first and putting money aside is as important as ever,

“Though everything seems to be getting more expensive, now isn’t the time to stop putting money away for the future. When inflation is high, you should be looking for easy investment options that will protect your savings, like term deposits, savings accounts, shares and managed or indexed funds; all of which can provide a better return on investment and help you save for big ticket items, such as a house deposit.”

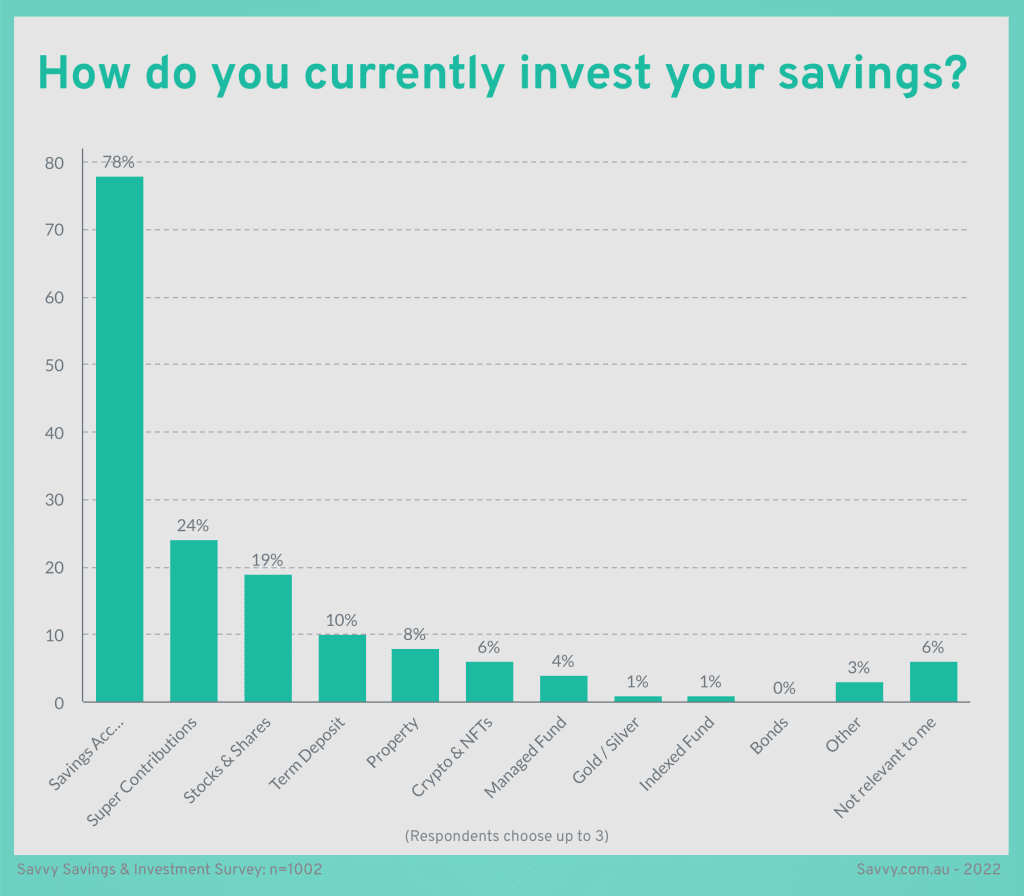

How are people currently investing their savings?

The top three places where Australians place their savings are savings accounts (78%), superannuation (24%) and shares (19%).

When given an opportunity to identify all preferred saving and investment vehicles, the vast majority of respondents, some 782 of a total 1002, use a savings account. This figure was slightly higher for females (80%) than males (76%). The division between sexes was more pronounced when it came to stocks and shares, which were chosen by 23% of males, compared with only 14% of females. Similarly, more men than women were contributing to their superannuation; 26% vs 21% respectively.

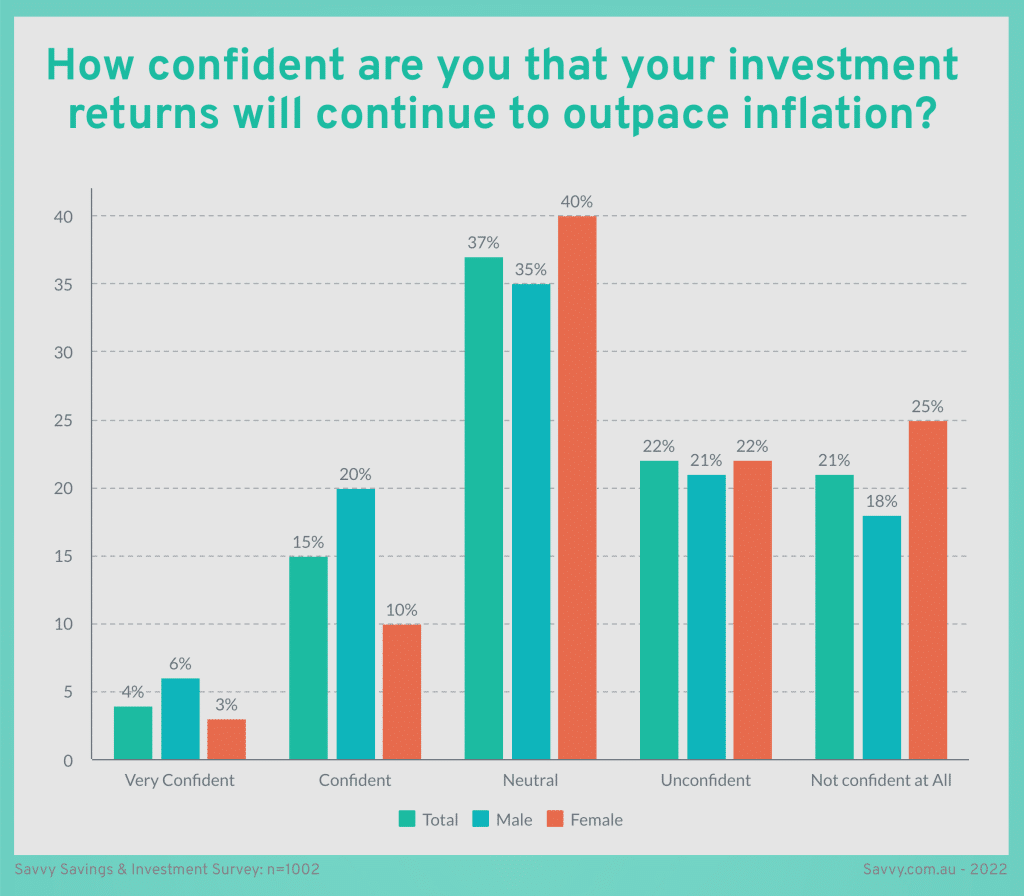

How confident are people about investment returns keeping up with inflation?

When it comes to returns on savings and investments, compared to rising prices, 43% of Australians are “not confident” that their investment returns will continue to outpace inflation in the near future.

While 37% of total respondents expressed a “neutral” sentiment, 22% of the 1002 total respondents were “unconfident”, while a further 21% were less optimistic again, answering “not confident at all”. Female survey participants were the least confident, with 25% choosing “not confident at all”, compared to 18% of their male counterparts.

For more information, contact Adrian Edlington – [email protected]

Savvy 2022 Savings Survey; n=1002

Nationally representative survey of 1002 adult Australians, aged 18 and over. Conducted by Octopus Group, on behalf of Savvy.

Completion date: 1/09/2022

Age groups:18-24, 25-34, 35-44, 45-54, 55-64, 65+

Gender breakdown: male n=499, female n=495, non-binary /prefer not to say n=6

Representative of state and territory populations:

NSW n=323 (32.3%), Vic n=248 (25.1%), Qld n=203 (20.2%), SA n=73 (7.2%), WA n=105 (10.6%) NT n=8 (0.7%), Tas n=23 (2.2%), ACT n=19 (1.7%)

Did you find this page helpful?

Author

Adrian EdlingtonPublished on September 20th, 2022

Last updated on March 15th, 2024

Fact checked

This guide provides general information and does not consider your individual needs, finances or objectives. We do not make any recommendation or suggestion about which product is best for you based on your specific situation and we do not compare all companies in the market, or all products offered by all companies. It’s always important to consider whether professional financial, legal or taxation advice is appropriate for you before choosing or purchasing a financial product.

The content on our website is produced by experts in the field of finance and reviewed as part of our editorial guidelines. We endeavour to keep all information across our site updated with accurate information.