- The Savvy Promise

At Savvy, our mission is to empower you to make informed financial choices. While we maintain stringent editorial standards, this article may include mentions of products offered by our partners. Here’s how we generate income.

As part of Savvy’s ongoing research into the economic and financial wellbeing of Australian families, our latest survey follows up 2022’s findings into mortgage stress.

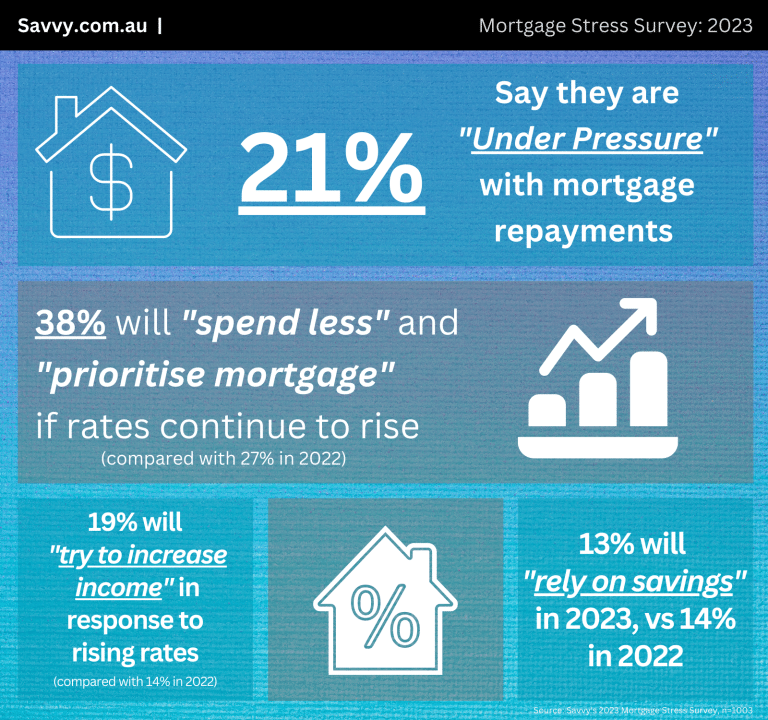

- 21% of respondents say they haven’t missed repayments but are “under pressure”

- 38% say that they will spend less and prioritise their mortgage if rates continue to rise

- 13% say they will rely on savings to offset the rate rises

- 19% say they will try to increase their income, up from 14.5% in last year’s survey

A representative survey of 1,000 Australians on interest rate rises and its impact on mortgages has shown that 21% of Australian mortgage holders are “feeling the pressure” of rate hikes, though have not missed any mortgage repayments.

Australian families have been battling nine consecutive Reserve Bank of Australia (RBA) official cash rate rises since May 2022. This has brought the record low 0.1%p.a. rate to 3.35%p.a. Rate rises are a response to rampant inflation, which stands at 7.8%.

Despite this, 2% of respondents said that they have missed repayments on their mortgage, with 1% saying they have missed many repayments and are worried about losing their homes to the bank. Sadly, two respondents of the 1000 said they had already had the bank foreclose on their mortgage.

21% say they own their home outright; 22% say they are renting and are not as concerned about rate rises as much as their homeowner counterparts.

Combatting Interest Rate Rises: Then and Now

With mortgage repayments tipped to increase further, 38% of Australians have indicated they will spend less and prioritise the mortgage to make ends meet. (41% male, 34% female.) This is up from 27% from our polling in August 2022. 62% of 35–44-year-olds indicated this was their method of funding rate rise increases.

19% said they would try to increase their income, up 4.5% from last year (14.5%).

13% said they would rely on savings (2022: 14.4%); 5% said they would pay the difference with money in offset accounts (2022: 6.75%); and 10% said they would try and lock in a fixed interest rate (2022: 12%).

1.7% said they would try to downsize their home (2022: 2.5%).

With recent RBA and bank increases in interest rates, mortgage repayments are expected to increase even further. How do you intend to fund the increase?

(Respondents choose top 3 answers)

No Data Found

| Given the recent increases in mortgage interest rates, what is most applicable to you? (in 2023) | Total | Male | Female | Other |

|---|---|---|---|---|

| I am managing my repayments ok | 27% (273) | 31% (157) | 23% (113) | 33% (3) |

| I haven’t missed repayments, though am feeling the pressure | 21% (213) | 22% (110) | 21% (102) | 11% (1) |

| I have missed repayments on my mortgage | 2% (23) | 3% (16) | 1% (7) | - (0) |

| I have missed multiple repayments and am worried about losing my home | 1% (7) | 1% (4) | 1% (3) | - (0) |

| I have missed multiple repayments and have had the bank foreclose on my mortgage | * (2) | * (2) | - (0) | - (0) |

| I don’t have a mortgage as I own my house | 21% (214) | 20% (102) | 22% (110) | 22% (2) |

| I am renting so not concerned about mortgage rate increases | 22% (222) | 18% (91) | 26% (129) | 22% (2) |

| Other | 5% (46) | 4% (20) | 5% (25) | 11% (1) |

Savvy Spokesperson, Adrian Edlington;

Says that people are indeed feeling the pressure of consecutive rate rises, contributing to the broader cost of living crisis.

“People are willing to tighten belts and go without to prioritise the mortgage, which is exactly what the RBA wants to see but is a harsh reality for families doing it tough,” he says. “If rates continue to rise, scrimping and saving to fund the mortgage has an end point. With reports saying that consumer confidence has hit another near historic low last month, we can only hope that three percent cohort who are missing repayments doesn’t increase as time goes on.” he says.

Savvy, Mortgage Stress Survey, 2023 (n=1000)

Nationally representative survey of 1000 adult Australians, aged 18 and over. Conducted by Octopus Group, on behalf of Savvy.

Completion date: 2/09/2023

Age groups:18-24, 25-34, 35-44, 45-54, 55-64, 65+

Gender breakdown: male n=506, female n=495, non-binary /prefer not to say n=4

Representative of state and territory populations:

NSW n=326 (32.3%), Vic n=253 (25.1%), Qld n=200 (20.2%), SA n=73 (7.2%), WA n=103 (10.6%) NT n=9 (0.7%), Tas n=23 (2.2%), ACT n=18 (1.7%)

Did you find this page helpful?

This guide provides general information and does not consider your individual needs, finances or objectives. We do not make any recommendation or suggestion about which product is best for you based on your specific situation and we do not compare all companies in the market, or all products offered by all companies. It’s always important to consider whether professional financial, legal or taxation advice is appropriate for you before choosing or purchasing a financial product.

The content on our website is produced by experts in the field of finance and reviewed as part of our editorial guidelines. We endeavour to keep all information across our site updated with accurate information.