- The Savvy Promise

At Savvy, our mission is to empower you to make informed financial choices. While we maintain stringent editorial standards, this article may include mentions of products offered by our partners. Here’s how we generate income.

In this article

As part of Savvy’s ongoing economic and social research, we look at Australia’s proposed Easter spending and travel plans contrasted with last year.

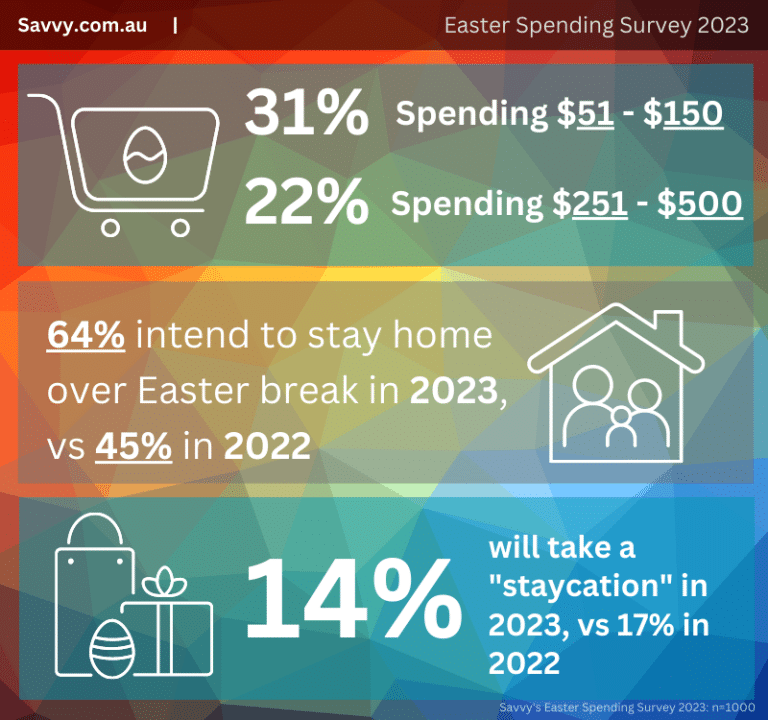

- 31% of Australians say they’ll be spending between $51 and $150 this Easter

- A further 22% will spend between $251 – $500

- 64% indicated they will be staying home over the Easter break in 2023, vs 45% in 2022

- 14% will travel in their state or territory in 2023, vs 26% in 2022

6% intend to travel interstate in 2023, vs 10% in 2022 - 14% say they will take a “staycation” in 2023, vs 17% in 2022

Intended spending

According to a nationally representative survey (n=1,000) of Australian’s spending habits around Easter 2023, 31% of Australians say they’ll be spending between $51 and $150 on Easter this year, while 22% say they will spend between $251 and $500. A further 27% said they would spend $50 or less this year. Totalled, this amounts to a whopping 80% of total respondents who will spend $500 or less in total this Easter.

This is a direct contrast to 2022’s figures, in which 58% said they were prepared to spend up to $500, as found in our 2022 survey: 73% of Australians had “money to burn”.

A similar lessening in spending sentiment year on year can be seen when comparing those expecting to spend between $500 and $1000. In 2022, 23% of the total 1003 respondents claimed they would spend this within this range, while in 2023 this figure dropped to 12%.

Of those intending to spend between $1000 and $2000 in total over Easter, the percentage dropped from 14% in 2022 to 5% in 2023.

Standout findings by state or age group found that:

37% of the 18–24-year-old demographic said they would be spending between $51-$100 during Easter; 44% of South Australians said the same. Equal amounts of the 45-54s and the 55-64s (34%) said they would be spending between zero and $50 on Easter – the demographic which usually skews towards buying chocolate eggs for grandchildren.

Only 1% of respondents said they would be spending $4,000 or more this Easter.

| How much are you planning to spend in total this Easter? (2022 Survey) | Total | Male | Female | Other |

|---|---|---|---|---|

| Total Respondents | 1003 | 500 | 501 | 2 |

| < $500 | 583 (58%) | 271 (54%) | 310 (62%) | 2 (100%) |

| $500 - $1000 | 226 (23%) | 106 (21%) | 120 (24%) | - |

| $1001 - $2000 | 137 (14%) | 91 (18%) | 46 (9%) | - |

| $2000 - $4000 | 44 (4%) | 24 (5%) | 20 (4%) | - |

| $4001 | 13 (1%) | 8 (2%) | 5 (1%) | - |

| How much are you planning to spend in total this Easter? (2023 Survey) | Total | Male | Female | Other |

|---|---|---|---|---|

| Total Respondents | 1000 | 502 | 489 | 9 |

| $0 - $50 | 267 (27%) | 138 (27%) | 125 (26%) | 4 (44%) |

| $51 - $150 | 306 (31%) | 138 (27%) | 166 (34%) | 2 (22%) |

| $251 - $500 | 223 (22%) | 109 (22%) | 111 (23%) | 3 (33%) |

| $501 - $750 | 70 (7%) | 36 (7%) | 34 (7%) | - |

| $751 - $1,000 | 57 (6%) | 34 (7%) | 23 (5%) | - |

| $1001 - $2000 | 47 (5%) | 31 ( 6%) | 16 (3%) | - |

| $2000 – $4000 | 18 (2%) | 10 (2%) | 8 (2%) | - |

| $4000+ | 12 (1%) | 6 (1%) | 6 (1%) | - |

Travel plans

64% of respondents in 2023 said they would be staying home over the Easter break, compared with 45% stating the same in 2022. Furthermore, 14% saying they would take a “staycation” – visiting local tourist destinations or leisure sites in 2023, down from 17% in 2022. 76% of over 65s indicated they would be staying home.

The same amount said they would travel within their own state in 2023 (14%) and 6% said they would travel interstate. These figures were down from 2022, when 26% said they would travel within their state, while 10% said they’d travel interstate.

Only 2% of people surveyed said they would be travelling abroad this year.

| What best describes your plans for the Easter 2022 break? | Total | Male | Female | Other |

|---|---|---|---|---|

| Total Respondents | 1003 | 500 | 501 | 2 |

| I will stay home | 448 (45%) | 227 (45%) | 219 (44%) | 2 (100%) |

| I will take a ‘staycation’ - go somewhere, but within your local area | 171 (17%) | 76 (15%) | 95 (19%) | - |

| I will travel somewhere in my state | 265 (26%) | 134 (27%) | 131 (26%) | - |

| I will travel interstate | 103 (10%) | 54 (11%) | 49 (10%) | - |

| I will travel abroad | 16 (2%) | 9 (2%) | 7 (1%) | - |

| What best describes your plans for the Easter 2023 break? | Total | Male | Female | Other |

|---|---|---|---|---|

| Total Respondents | 1000 | 502 | 489 | 9 |

| I will stay home | 635 (64%) | 313 (62%) | 316 (65%) | 6 (67%) |

| I will take a ‘staycation’ - go somewhere, but within your local area | 144 (14%) | 76 (15%) | 67 (14%) | 1 (11%) |

| I will travel somewhere in my state | 136 (14%) | 70 (14%) | 65 (13%) | 1 (11%) |

| I will travel interstate | 60 (6%) | 32 (6%) | 27 (6%) | 1 (11%) |

| I will travel abroad | 25 (2%) | 11 (2%) | 14 (3%) | - |

Savvy Spokesperson;

Finance expert and Savvy spokesperson Adrian Edlington says that Australians are well and truly feeling the pinch of economic conditions and Easter is the first major holiday to see a potential downturn in spending.

“Easter isn’t as big as a holiday for Australians as Christmas. If there’s cash to splash, Aussies tend to spread it around. These results indicate that people are tightening their belts this Easter, which owes much to inflation and the ten consecutive interest rate rises."

“This is the first Easter in memory when a deluxe chocolate egg can cost upwards of twenty dollars or more. Buying three or four of those for kids and cousins really does add up. Our most recent survey that had thirty-eight percent of Aussies saying they’d prioritise their mortgage over discretionary spending seems to be filtering through to Easter.”

Savvy, Easter Spending Survey, 2023 (n=1000)

Nationally representative survey of 1000 adult Australians, aged 18 and over. Conducted by Octopus Group, on behalf of Savvy.

Completion date: 2/09/2023

Age groups:18-24, 25-34, 35-44, 45-54, 55-64, 65+

Gender breakdown: male n=502, female n=489, non-binary /prefer not to say n=9

Representative of state and territory populations:

NSW n=312 (32.3%), Vic n=246 (25.1%), Qld n=196 (20.2%), SA n=70 (7.2%), WA n=104 (10.6%) NT n=14 (0.7%), Tas n=36 (2.2%), ACT n=22 (1.7%)

Did you find this page helpful?

Author

Savvy Editorial TeamPublished on March 23rd, 2023

Last updated on March 14th, 2024

Fact checked

This guide provides general information and does not consider your individual needs, finances or objectives. We do not make any recommendation or suggestion about which product is best for you based on your specific situation and we do not compare all companies in the market, or all products offered by all companies. It’s always important to consider whether professional financial, legal or taxation advice is appropriate for you before choosing or purchasing a financial product.

The content on our website is produced by experts in the field of finance and reviewed as part of our editorial guidelines. We endeavour to keep all information across our site updated with accurate information.