- The Savvy Promise

At Savvy, our mission is to empower you to make informed financial choices. While we maintain stringent editorial standards, this article may include mentions of products offered by our partners. Here’s how we generate income.

In this article

As part of our ongoing research into Australian financial wellbeing, Savvy takes a comprehensive look at private health insurance among Australians amid the rising cost of living and inflation.

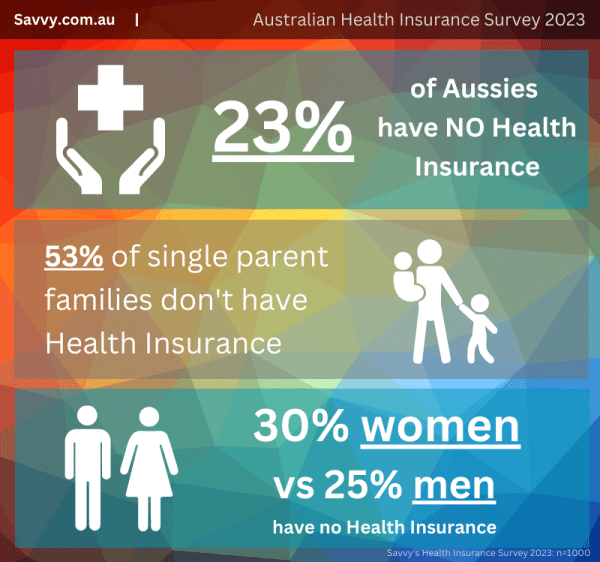

- 23% of Australian families don’t have private health insurance

- 53% of Australian single parent families don’t have private health insurance

- Individuals are spending between $41-$50 on private health insurance

- 30% of women vs 25% of men don’t have private health insurance

A nationally representative survey commissioned by Savvy (n=1,000) has revealed that almost a quarter of Australian families (23%) are going without private health insurance while another quarter are spending more than $81 per week on premiums.

With costs of living rising and inflation biting – with this week marking 11 RBA official cash rate rises in 12 months – Australian families are looking at their finances and wondering where they can make savings.

12% of those surveyed said they would downgrade their private health cover with another 12% saying they would switch providers to find a better deal; the 35-44s & 45-54s being most likely to. 7% would cancel their extras, with the 18–24-year-old cohort being most likely to do so (11%.)

7% would cancel their policy completely. 28% said they would not make any changes to their policy at current, with the over 65s being the most likely to do so (38%).

| With current inflation and cost of living rising, what are you likely to do regarding your private health insurance? | Total | Male | Female | Other |

|---|---|---|---|---|

| Total Respondents | 1000 | 502 | 489 | 9 |

| Comfortable paying more | 51 (5%) | 31 (6%) | 20 (4%) | - |

| Downgrade cover | 116 (12%) | 73 (15%) | 43 (9%) | - |

| Cancel policy completely | 71 (7%) | 35 (7%) | 36 (7%) | - |

| Switch provider to find a better deal | 121 (12%) | 49 (10%) | 71 (15%) | 1 (11%) |

| Cancel extras | 67 (7%) | 32 (6%) | 35 (7%) | - |

| Upgrade cover to get better value | 21 (2%) | 10 (2%) | 11 (2%) | - |

| No change | 276 (28%) | 144 (29%) | 127 (26%) | 5 (56%) |

| I don’t have health insurance | 277 (28%) | 128 (25%) | 146 (30%) | 3 (33%) |

Many Australians forgoing private health insurance

Alarmingly, 37% of singles and 31% of couples have no private health insurance to speak of – and over half (53%) of single parent households have no private health insurance.

As for the gender breakdown, women are more likely to not have any private health insurance (30% vs 25% of men.)

Overall, 28% of Australians say they don’t have any active health insurance policies.

Savvy spokesperson; Adrian Edlington

“With costs of living only seeming to go up, people who feel fit and healthy may be looking at their private health insurance and wondering, ‘is this worth paying for?’,” says Savvy spokesperson Adrian Edlington.

“Of course, that’s why we have insurance, to prepare for the unexpected.

“If they haven’t figured out whether paying for private health insurance is more cost-effective after the rebate and being saddled with the Medicare levy, now is the time to make that calculation. The benefits will usually outweigh the costs, even if it’s just peace of mind.”

Why choose private health insurance in Australia?

All Australian citizens and permanent residents are eligible for the universal health care scheme known as Medicare, which guarantees free or low-cost health treatment for a range of illnesses, surgeries, and other procedures. However, anything “free” from the government is paid for out of our taxes. To relieve the burden on the public health system, the Federal Government introduced a rebate for couples and singles that take out an appropriate level of health insurance. Anyone with an appropriate level of health insurance may also be eligible for a waiver of the Medicare levy surcharge if your income is above $90,000 for singles and $180,000 for couples, plus $1,500 for each dependent child after the first one.

This is a charge of 1%, 1.25%, or 1.5% based on your taxable income and associated benefits (fringe benefits, for example.) Private health insurance usually guarantees you a higher level of care either in public or private hospitals, reduced waiting times for surgeries, and access to a preferred doctor. It also provides rebates for other health procedures such as dental, physiotherapy, optical, and even mental health.

What is the best health insurance for me?

The best private health insurance for you needs to suit your life stage. The “best” health insurance for a pregnant family may not be the best health insurance for seniors, while the best health insurance for those with mental health conditions may not be the best health insurance for a growing family.

You need to choose a level of coverage that suits your budget and your needs. You also need to factor in an excess – just like car insurance, you will need to pay an excess when you claim. Some insurance premiums include obstetrics and gynaecology services (pregnancy) while others may omit them for life-stage appropriate care such as palliative care. You need to weigh up what your insurance includes and doesn’t and select what suits best.

How can I choose the best health insurance for extras?

When people refer to “health insurance” they usually are talking about hospital cover – if you are covered for emergency or elective surgeries and hospital stays in the private system. However many opt for health insurance extras: the best health insurance for extras cover alternative medicines, allied health, and even dental work. Many extras include ambulance coverage, optical (covering the cost of glasses), dental (major and minor), massage and physiotherapy, naturopathy, psychology, remedial massage, and other health services. Of course, the more extras you want means a higher monthly premium. Striking the right balance between hospital cover and extras (known as “packaged cover”) is something to consider – although you can just opt for “extras” cover distinct from hospital cover. Some packaged cover may include the best health insurance for major dental work – which can cost a lot for growing families, especially when orthodontics and other ongoing dental work is required.

However, you can take out hospital cover and extras cover with different providers to gain the most value.

Savvy, Rental Stress Survey, 2023 (n=1000)

Nationally representative survey of 1000 adult Australians, aged 18 and over. Conducted by Octopus Group, on behalf of Savvy.

Completion date: 5/06/2023

Age groups:18-24, 25-34, 35-44, 45-54, 55-64, 65+

Gender breakdown: male n=502, female n=489, non-binary /prefer not to say n=9

Representative of state and territory populations:

NSW n=312 (32.3%), Vic n=246 (25.1%), Qld n=196 (20.2%), SA n=70 (7.2%), WA n=104 (10.6%) NT n=14 (0.7%), Tas n=36 (2.2%), ACT n=22 (1.7%)

Sources:

ATO.gov.au - Appropriate Level of Private Patient Hospital Cover

Did you find this page helpful?

Author

Adrian EdlingtonReviewer

Thomas PerrottaPublished on June 12th, 2023

Last updated on April 30th, 2024

Fact checked

This guide provides general information and does not consider your individual needs, finances or objectives. We do not make any recommendation or suggestion about which product is best for you based on your specific situation and we do not compare all companies in the market, or all products offered by all companies. It’s always important to consider whether professional financial, legal or taxation advice is appropriate for you before choosing or purchasing a financial product.

The content on our website is produced by experts in the field of finance and reviewed as part of our editorial guidelines. We endeavour to keep all information across our site updated with accurate information.