- The Savvy Promise

At Savvy, our mission is to empower you to make informed financial choices. While we maintain stringent editorial standards, this article may include mentions of products offered by our partners. Here’s how we generate income.

In this article

Kids and Teens today are more switched on than ever before when it comes to new technology, apps and gadgets. Growing up as digital natives in a hyper-connected world, today's youth are exposed to many more opportunities to spend money than any generation before. When it comes to developing good money habits, the challenges posed by this connectivity seem greater too.

So how can parents and caregivers approach the conversation of good money habits? Or how can kids and teens empower themselves? In this guide, we’ll show everyone how.

In our 2020 Financial Literacy survey about a third of respondents had never discussed savings or investments with their children; 43% have never discussed reducing tax; and 30% have rarely or never discussed good and bad financial habits with their kids.

Games – a taste of the economy

If you’re a kid, you already know about value. You know that a chocolate bar is worth more to your friends than an apple. Whether buying or bartering, you know that valuable things aren’t free. You already know buying a Booster Pack in an online game is worth 10 or 20 hours of grinding. You also know that buying Mayfair is worth much more in the long run than buying Old Kent Road in Monopoly. These are all lessons parents and children can use to become financially literate.

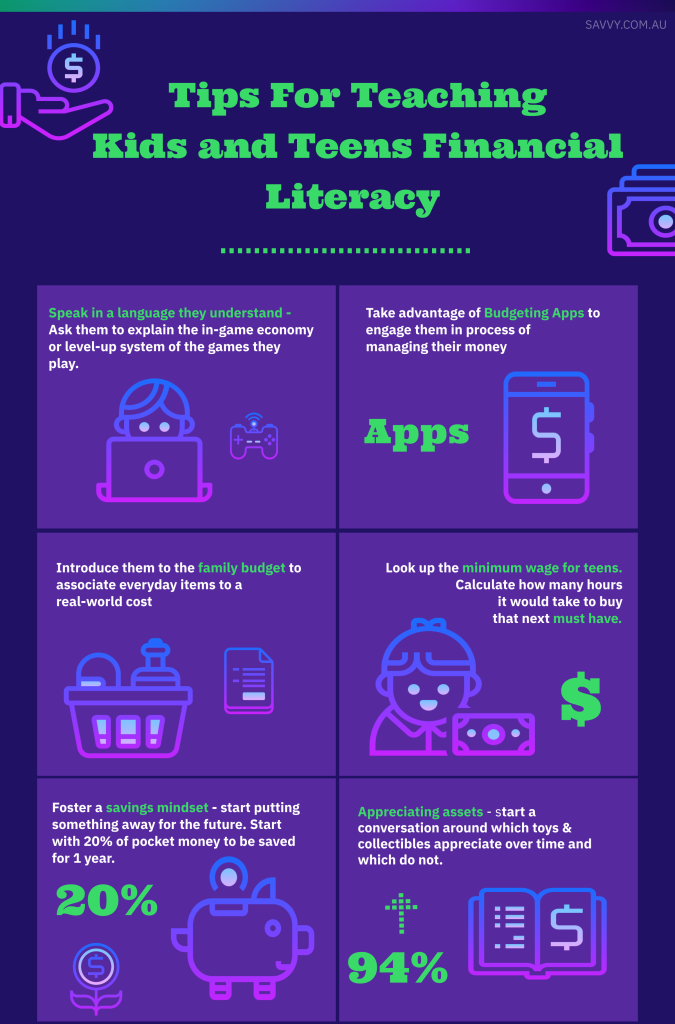

Speak in a language they understand: Videogame economies, currency, and “XP”

If your child or teen plays video games, try talking about value and scarcity in terms of the games they’re playing.

Ask for an explanation of the in-game currency and items they’re “grinding.”

“Grinding” (in the video-game sense) refers to putting in the “work” or “time” to build up Experience Points (XP) or “Money/credits” to level up or unlock better quality items or skills. In this sense, it’s much like life – except faster and more fun – though if you’ve ever heard your child cursing at a screen, you might wonder about the fun part!

The point is anything worth having takes hard work and patience. If it’s too easy, we take it for granted and value it less. Games deliberately create an economy based on scarcity, with the best items and levels being hardest to obtain. Players will diligently dedicate hours to a game to “level up” or “buy” that next epic item. (It starts to sound a lot like work in the real world!)

This scarcity hooks kids and teens on a game, who in turn are happy dedicating hours upon hours to get that which their hearts desire.

Tip: Ask your child of any age to explain the in-game economy and level / tier system of the games they play. Try to follow along and try to sound interested!

Using games with in-world economies is a springboard for learning about real world economics. Legendary items are more sought after and require more currency – common items don’t. Just like how a sports car is worth a lot of money and a loaf of bread is cheap to buy by comparison. This is an introduction to the world of value.

Let’s say you set up the Bank of Mum and Dad – with real world interest charges! Let’s say you reward your child for saving with 10% interest per month. So, if your child has $100 in savings per month, they will end up with $110. They can also borrow against future earnings by taking out a loan for their must-have possession. However, they will have to pay it back over time with 5% interest. They have the benefit of getting their console or PC right now but will have less pocket money each month as they pay off the loan and will have to budget more effectively.

Tip: Learn to speak to kids about value in language they understand. Ask them to explain how the item trading system works on their favourite game. How do you “earn” money in the game. What can it buy? What are they saving for?

Learning about spending and income

Learning about income at an early age also helps kids with financial responsibility. If your kids want that PC, they will have to save up for it.

Parents can set up a bank account for kids; but the most practical way to help them is by managing their pocket money with apps and debit cards. Two such apps are Rooster Money and Spriggy.

Kids can see on their phones how their work contributes to their savings, how much they need to meet their savings goals, and even introduce them to concepts such as interest and superannuation.

Saving and budgeting

As the Bank of Mum and Dad offers interest on savings, this shows kids that there is an incentive to save money for “future you.” You may not need a new bike right now, but “future you” might need one. Having a budget set up may teach them that they can take out the loan for the games console, pay back the interest, and have a little left over to save – or spend on lollies or skins. It will teach them that they can’t have everything – and a bank won’t cover them forever, especially if they cannot afford the repayments. Rooster Money and Spriggy helps kids budget using the smartphone apps.

Tip: Connecting value with work & labour. Before you buy or gift your children the latest PC or console, look up the base pay rate for minimum working-age teens in your area. Then have them divide the purchase price by how many hours of real work that would require to buy. Once they’ve recovered from the shock, work out how long it would take to save that amount of money, if they worked 10 hours a week, remember to deduct tax!

Dangerous debt vs. good debt

Following on from interest and debts is bad debt and good debt. A bad debt is a debt that has no return on investment, e.g., a game console or piece of electronics that slowly loses value until it’s worthless. A good debt is something that does return an investment, such as a baseball or football card that gains in value over time.

Tip: Look up online to find the toys, cards and collectibles that have gone up in value and are worth much more today than they were when new. Which current possessions might be worth holding onto?

Explaining the family budget

At different ages, you should introduce the idea that parents work to pay the family expenses. Money doesn’t grow on trees – but your children should have a concrete knowledge of where it does come from.

Start with the household items children can see and use:

- Food & Groceries

- Eating Out

- Utilities: Electricity, water and gas.

- Internet & phone! Many kids start to think of WiFi and phone credit as a birth right. It is important for them to learn that this is not free.

Tip: Divide the total utilities by the number of people in the household. This way kids and teens can learn what it costs just to live in the way you do. Couch it in terms they can understand – at their minimum wage, how much could they afford?

Grocery shopping as a Lesson

Do your children know how much you spend per week on groceries? The fridge doesn’t fill itself for free, right?

While your children might help carry the shopping and put it away, they may be unaware of exactly how much it all costs. Shielding them from this doesn’t help teach them the true cost of living.

Compare the cost of a big grocery shop versus the cost of eating out. How many groceries can you buy for the cost of one decent meal out?

Tap and pay

Tap and pay is a convenient way to pay for smaller items and disposable purchases. If you’re using a credit card, this can attract interest (bad debt.)

Teaching Tip: Instead of using tap and pay with a credit card, only allow your child to use it with a debit card. This means you are using your own money. Once the money in the account runs out, you can’t use it anymore. This can teach budgeting for kids and teens. Load up a tap and pay debit card at the start of the week – and they have to make it last until the end of the week.

Other tips for parents

1) Set your kids up with bank accounts

You can set your kids up with bank accounts – and even have joint chequing accounts until they’re 16. Also involve them in choosing a bank – some banks may charge fees while others don’t.

2) Put them in charge

Instead of buying petrol, clothing, and other basics for your kids, allot a certain amount of money a few times a year and let them know they're in charge of making it last until their next “payday.”

3) Foster a savings mindset

Remember the lesson about “future you.” Putting a small amount away each week or month can be used to save up for a big item or for a “rainy day.”

4) Teach them some insurance basics

If you have a teen driver, start with car insurance. Explain the purpose of insurance: to cover big costs that would otherwise be difficult to cover on their own. Review the policy and give special attention to deductibles — a concept that's also useful when dealing with other coverage like health, renters, or home insurance.

5) Credit card smarts

Manage small amounts of debt. Tutor children about interest and minimum repayments, and a credit history or credit score. Having too much debt can damage your credit score. Don't be afraid of talking to your child openly about where money comes from. When are you paying with cash, relying on your credit card or using a personal loan?

6) Charity and giving back

Remember to instil values of charity and giving back to the community. Some of us are less fortunate and need help – and who knows, we may have to rely on charity in times of crisis. The community can help us out in times of need and it’s our responsibility to do the same.

7) Seeing a financial adviser

This one is more for the adults – seeing a financial adviser and getting a handle on your own money matters makes conversations with kids and teenagers easier as you begin to understand money and finance better. It not only helps your kids, but your entire family.

Did you find this page helpful?

Author

Adrian EdlingtonGuest Contributor

Thomas PerrottaPublished on November 8th, 2021

Last updated on March 19th, 2024

Fact checked

This guide provides general information and does not consider your individual needs, finances or objectives. We do not make any recommendation or suggestion about which product is best for you based on your specific situation and we do not compare all companies in the market, or all products offered by all companies. It’s always important to consider whether professional financial, legal or taxation advice is appropriate for you before choosing or purchasing a financial product.

The content on our website is produced by experts in the field of finance and reviewed as part of our editorial guidelines. We endeavour to keep all information across our site updated with accurate information.