- The Savvy Promise

At Savvy, our mission is to empower you to make informed financial choices. While we maintain stringent editorial standards, this article may include mentions of products offered by our partners. Here’s how we generate income.

In this article

Australia’s soaring inflation has made it increasingly difficult for households to pay essential expenses. House costs, petrol prices and groceries are the biggest culprits. It raises the question, how do wages compare with the cost of living? And what disposable incomes do households actually have? In this report, we analyse the average income of Australians for the last financial year, how it differs between states and tips to optimise your disposable and discretionary income.

Key takeaways

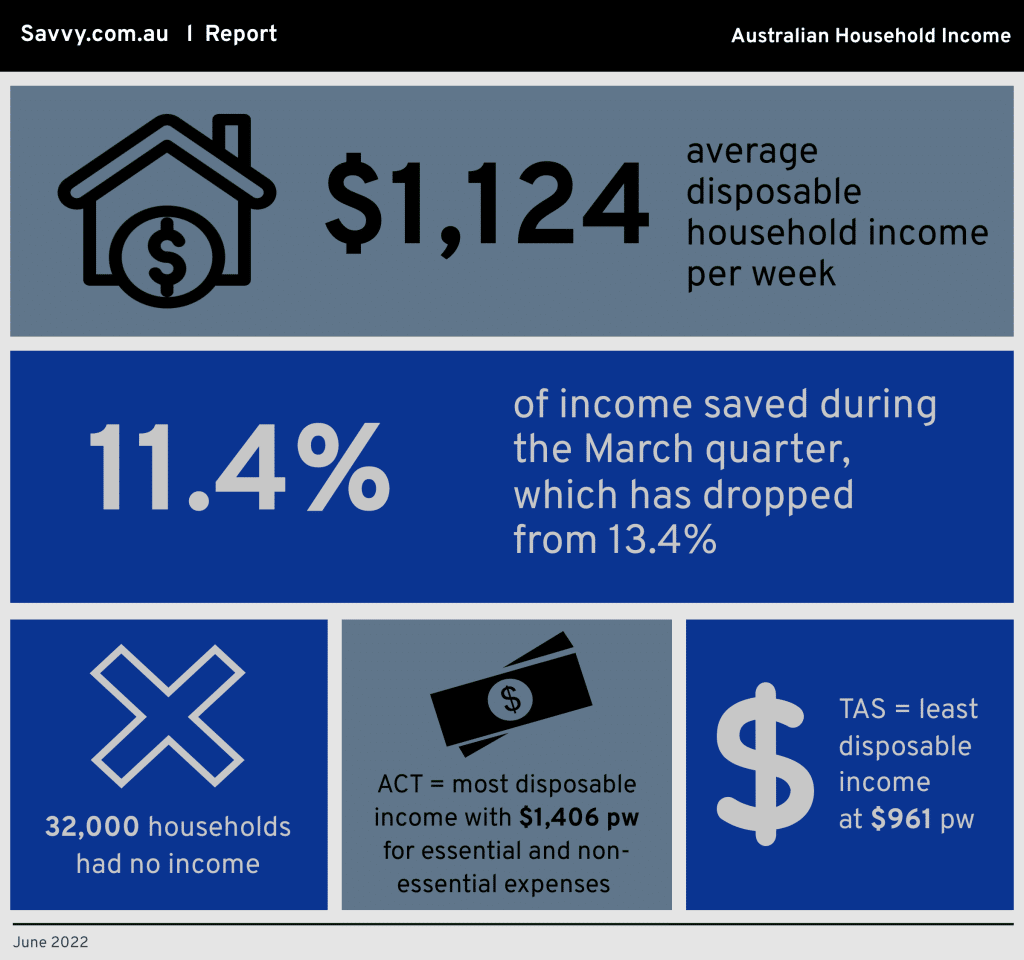

- The average disposable household income was $1,124 per week

- 75% of households had debt in 2019-20

- The number of households with $2,000 or more in disposable income per week

- increased by almost 500 compared to the last financial year

- Aussies continue to save and have stockpiled 11.4% of their income

- Tasmania had the least amount of cash left over after paying tax

- The Australian Capital Territory had the most disposable income

- 32,000 households had no income

- The average net worth for all Australian households in 2019–20 was $1.04 million

- 1 in 4 Aussies are feeling the strain of the costs of living

- Household discretionary income forecasted to rise by 2.6% in 2021-22 to $640 billion

2.3% increase in disposable income predicted for this financial year

On average, the equivalised disposable household income for the last financial year was $1,124 per week. More than 6,000 Australians had between $1,000 and $1,500 left over after taxes to use for essential expenses. However, there were 3,100 with less than $500 of disposable income per week.

The real household disposable income is forecasted to be $1.2 billion in 2021-22 indicating an increase of 2.3%. Compared to December, disposable income grew from $35 million to more than $36 million in the first quarter of 2022. This increase is driven by a rise in working hours. But there is a record number of people working multiple jobs to make ends meet.

In fact, an estimated 867,000 Australians were working more than one job in the December quarter. This is the highest number of people since 1994.

Debt is still very much a problem

One in four Australians is struggling to stay afloat, despite the promising rise in disposable and discretionary income.

The cause is rising interest rates and inflation which are having a significant impact on day-to-day budgets. High petrol costs and food prices are the number one topics around the kitchen table, with more households experiencing financial stress. Low-income earners, renters and singles are the most concerned about their financial situation.

With 75% of households in debt in 2019-20, it proves finances remain an issue for many people.

That equals three in four households, which is more than 7,000 homes across the country. 91% of these had two or more employed people, while 44% received government pensions and allowances. This is a slight increase from the previous financial year which saw 39% receive financial support.

65% of households in debt are renting compared to 61% in the previous financial year. Only 55% are owners without a mortgage, while the majority are still paying off their properties. 91% of those in debt are couple families with children. The highest age group bracket is 35 to 44 years old.

It comes as no surprise as inflation has risen by 5.1% between March 2021 and 2022, with the cost of mandatory items such as housing, debt, taxes and groceries spiking by 3% in the March 2022 quarter alone. An inflation rate of 5.1% means, on average, you need $105.10 today to buy what $100 bought a year ago.

State-by-state guide

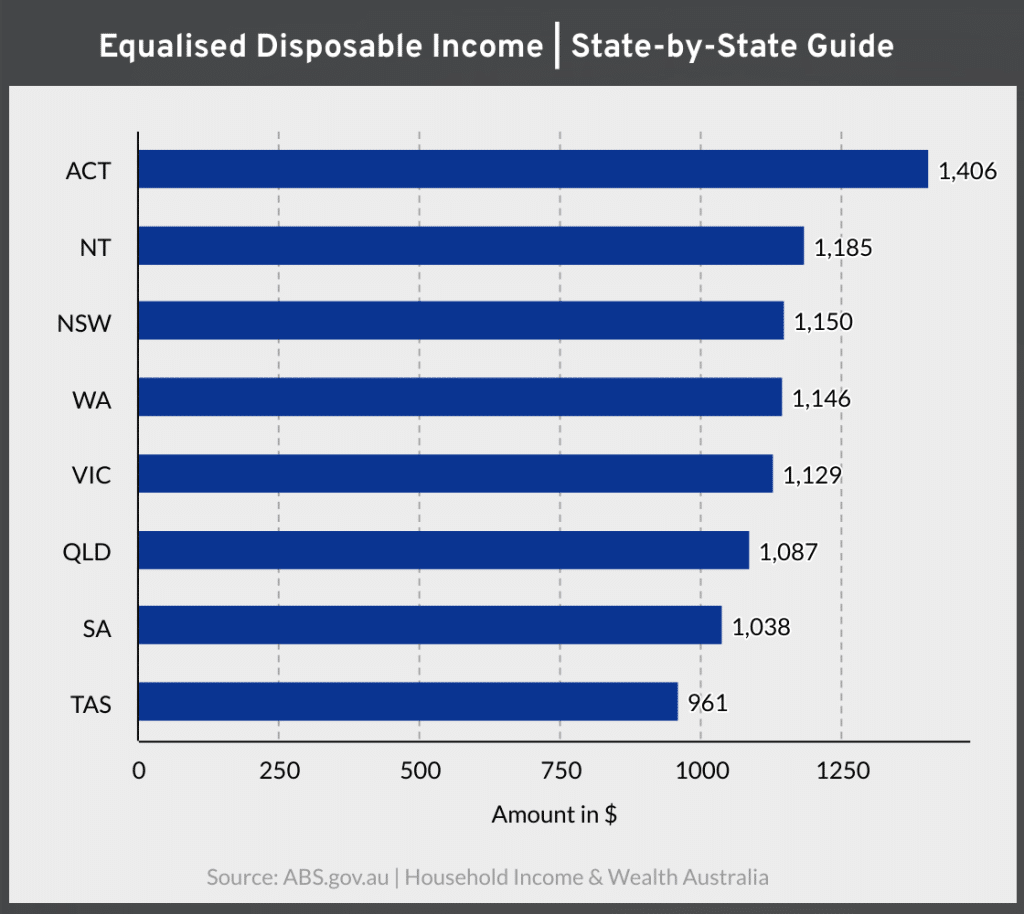

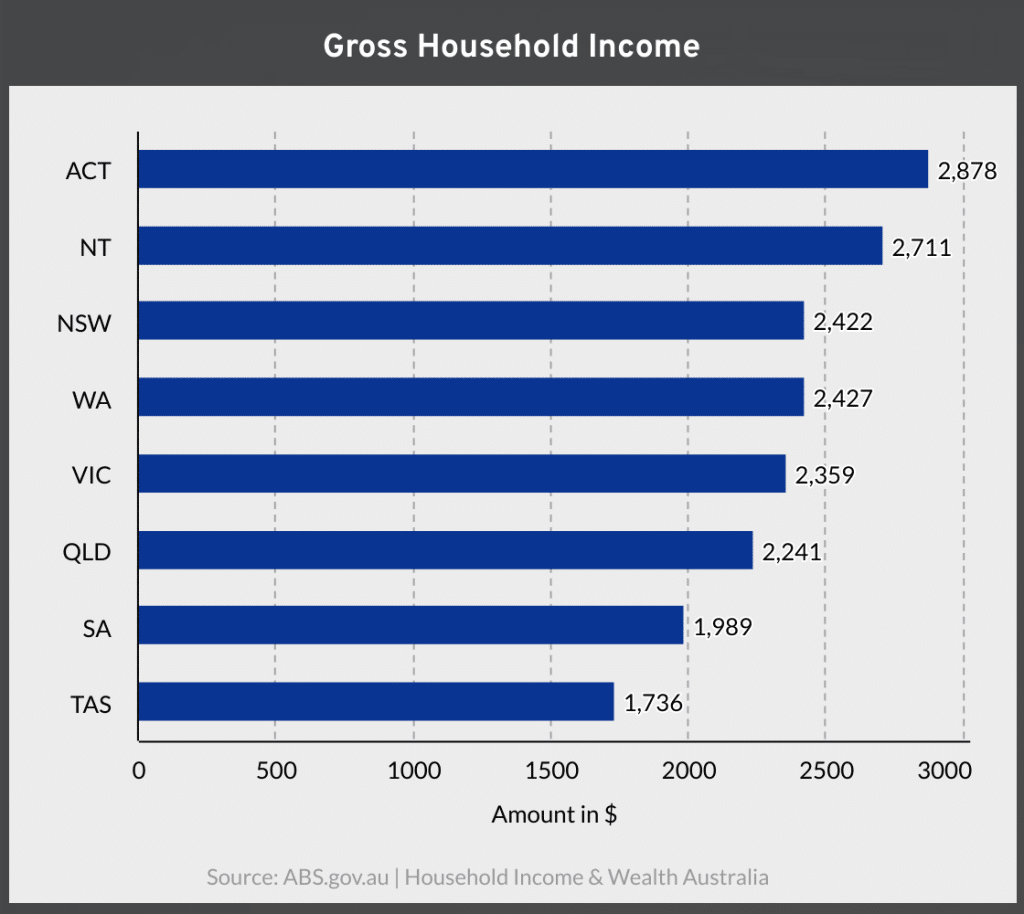

The Australian Capital Territory had the most disposable income in 2019-20, with an average of $1,406 left over to pay for essential and non-essential living expenses. This is an increase from the previous financial year which recorded $1,294 and is likely due to higher wages. Compared to the rest of Australia, the gross household income is also considerably higher at $2,878 per week.

The Northern Territory ($1,185), New South Wales ($1,150) and Western Australia ($1,146) came in second, third and fourth places for the highest amount of disposable income per household per week.

Meanwhile, those living in Tasmania had the lowest equalised disposable income at $961. While this has increased slightly since the last financial year, the state also records the lowest weekly household income at $1,736.

31.9% of people living in Tasmania relied on government pensions and allowances as their main source of household income. On the other hand, The Australian Capital Territory recorded the lowest percentage of government support at 10.2%.

The Northern Territory had the highest employee income with 78.9% of households working. This was followed by The Australian Capital Territory (70.2%), Western Australia (65.7%), Victoria (62.1%) and New South Wales (62%). In terms of own unincorporated business income, Victoria recorded 3.8% households, followed closely by South Australia (3.7%), Western Australia (3.4%) and Tasmania (3.4%).

Is there poverty in Australia?

As Australia’s cost of living continues to soar it is becoming increasingly difficult to afford the basics. Combined with the rising rent, millions of people are now living in severe poverty. The Organisation for Economic Cooperation and Development (OECD) defines the poverty line as half the median household income of the total population. It is currently assessed by two lines – 50% of median income and 60% of median income. Those people living below these incomes are regarded as living in poverty.

A report by the Poverty and Inequality Organisation found that there were 3.34 million people living below the poverty line of 50%, which is more than one in eight adults and one in six children.

In dollar figures, this translates to $426.30 a week for a single adult living alone and $895.22 for a couple with two children. With 32,000 households recording no income in the last financial year, an increase from 22,000, it is evident many are struggling to keep pace with the nation’s rising cost of living.

Income remains elevated but savings are down

The average equivalised disposable household income was $1,124 per week. On the higher end of the scale, the median income after taxes was $1,670 per week. When you take into account the everyday living expenses and the average household spend, however, you can start to see why the rising prices are burning a hole into the pockets of Australians.

It is devastating for low-income earners and mortgage holders, in particular.

The good news is that there are 2,095 households with a weekly disposable income of $2,000 or more to meet essential and non-essential living expenses. This has improved by almost 500, increasing how much money people are able to put away.

As a result, households saved 11.4% of their income during the March quarter. While this figure remains elevated it has dropped from 13.4% in the December quarter and easing towards pre-pandemic levels. 45.4% of all households have saved regularly over the last 12 months, while 47.2% followed a budget.

A recent report from Commonwealth of Australia shows that 51% of respondents are saving for travel, despite the pressure of inflation. Now travel is firmly back on the agenda, the urge to get away has been reflected in recent spending trends with a 14.9% increase in travel spending for January 2022 vs January 2021. This includes forking out funds for travel agents, cruise ships, airlines, airport spending and motor homes and RV rentals.

Household spending and cost of living

Household spending increased by 7.6% throughout the year, with Queensland (+11.4%) and South Australia (+9.5%) having the highest expenditure.

The biggest offenders breaking the bank are groceries, rent, coffee, petrol and international travel. Rent and dwelling costs are the largest expense. On average, it costs Australian households $444 per week for housing. Food and groceries are the second-highest expense costing an average of $210 per week, followed by recreation and culture ($208).

What are the top financial stress indicators?

Being unable to raise $2,000 in a week for something important was the top financial stress indicator at 34%. The second was the inability to raise $500 in a week (16.7%), followed by unable to pay power, gas or phone on time (15.6%) and spending more money than received (14.7%).

Despite the economic strain, 86.4% of households did not have difficulty paying bills in the last 12 months while 6.4% admitted to having trouble three to five times.

How you can protect yourself from the rising cost of living

- Decrease your spending in small chunks

- Switch and save on utilities

- Get savvy at the supermarket

- Research into competitive home loan rates

- Ditch the major supermarkets for cheaper fresh produce or grow your own

Sources:

ABS.gov.au - Household Income and Wealth, Australia

Statista.com/statistics - Distribution-of-household-income-australia

Finder.com.au - Australian-household-spending-statistics

Ibisworld.com - Real-household-disposable-income

Ibisworld.com - real-household-discretionary-income

ABS.gov.au - 12-things-happened-australian-economy-march-quarter-2022

Did you find this page helpful?

Author

Satwik ChavdaPublished on July 1st, 2022

Last updated on March 18th, 2024

Fact checked

This guide provides general information and does not consider your individual needs, finances or objectives. We do not make any recommendation or suggestion about which product is best for you based on your specific situation and we do not compare all companies in the market, or all products offered by all companies. It’s always important to consider whether professional financial, legal or taxation advice is appropriate for you before choosing or purchasing a financial product.

The content on our website is produced by experts in the field of finance and reviewed as part of our editorial guidelines. We endeavour to keep all information across our site updated with accurate information.