Classic Car Loans

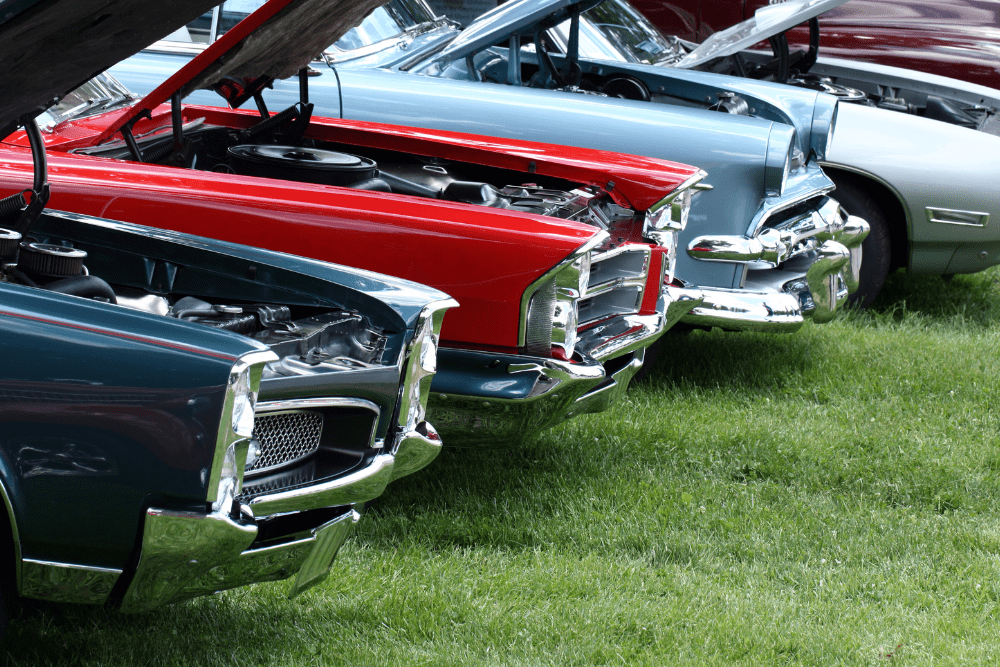

Looking for a helping hand buying your dream classic car? With flexible lending partners offering car loans with no age limit, Savvy can help you out.

Author

Bill TsouvalasFact checked

Buying a classic car is the dream for many drivers across Australia, but they aren’t usually eligible for standard car loans. That’s where Savvy comes in. We’re partnered with flexible lenders who can accept vintage models as security and offer competitive rates in the process.

Whether you’re in the market for a muscle car, restored vehicle or an imported one that otherwise wouldn’t be accepted, we can help you access financing when you need it. Get started with a quick quote now to tell us more about yourself and the car you’re after and you can get approved before you know it!

What is a classic car?

There’s no one definitive classification for which cars are classics and which aren’t. However, according to Sheen Panel Service, the following categories are most commonly accepted by Australian classic vehicle clubs:

- Veteran: manufactured before 1918

- Vintage: manufactured from 1919 to 1930

- Post vintage: manufactured from 1931 to 1949

- Classic acceptance: manufactured from 1950 to 1969

- Modern classic: manufactured from 1970 to 1989

Other lenders may consider any car over 20 years as a classic vehicle, including a range of imported, restored and muscle models in this classification. Because of this, it’s worth considering your lender’s vehicle qualification criteria (which we can check for you).

What is a classic car loan?

As the name suggests, a classic car loan is a finance agreement designed to help you purchase a classic vehicle. It’s a specialised product offered by certain lenders in Australia. Because of the nature of classic cars, this type of loan is less common, but shares a number of key similarities with regular car loans, including:

- Secured loans

- Payable over one to five years (seven may be available with certain lenders)

- Fixed interest rates

- Repayable weekly, fortnightly or monthly (depending on your lender)

How do classic car loans differ from standard car loans?

While they’re very similar in a range of areas, classic car loans have several unique characteristics that differentiate them from standard used car loans.

Naturally, classic cars are much older than cars typically purchased for everyday use, and standard car loans usually have age restrictions that limit how old the car can be to qualify for finance. This can range from as little as ten years or less up to 20 to 25 years with some lenders.

However, classic car loans don’t have any such restriction. Additionally, they can be used for different kinds of cars, such as vintage or muscle cars, that aren’t likely to be approved for standard car financing.

Classic car purchases are treated as investment, rather than a standard car which is expected to depreciate rapidly, and may also have stricter credit requirements to qualify for a loan.

What are the credit requirements?

To qualify for a classic car loan, you’ll generally need a good credit score. Some of the factors in maintaining a good credit score are never having defaulted on any previous loans and having a generally good repayment history on previous loan facilities.

A good credit score is usually around 600 or higher and may go up to either 1,000 or 1,200 depending on the credit reporting agency. If you don’t have a good credit score, you may find it more difficult to find a lender willing to finance your classic car purchase without charging you higher interest rates and fees.

Additionally, you’ll need to prove that you have the ability to repay the loan according to the agreed repayment schedule. This means being able to demonstrate that you have a job or other regular income, and don’t spend beyond your means. The lender will request evidence of your income, usually through some recent payslips, as well as an analysis of your current expenses, assets and liabilities.

Of course, the standard credit requirements for any loan or line of credit will also apply: you’ll need to be an Australian citizen or permanent resident over the age of 18. Because a classic car is a big investment, lenders tend to prefer a strong borrowing profile, so having a stable, long-term job and owning a home will help to increase your eligibility for lower interest rates. A deposit can also be very helpful when taking out a classic car loan.

Why Savvy is the best place to find classic car loans

100% online application

There is no need to send any physical paperwork; everything is online with Savvy, so you don't have to leave the comfort of your home.

Experienced consultants

Our consultants stick with you through the whole process, ensuring that your application meets your lender’s standards to maximise approval chances.

Accredited and informed

As an FBAA-accredited broker, we only partner with the most reputable lenders across the country to find you the ideal used car loan.

What our customers say about their finance experience

Savvy is rated 4.9 for customer satisfaction by 3819 customers.

How do I qualify for classic car financing?

Have a strong credit score

A significant factor that will affect your chances of approval is your credit rating. Lenders give this number a significant amount of weight when considering applications. There are several ways you can look to maximise your rating prior to applying for classic car financing. Lowering the limits on your credit cards and getting rid of any cards you don’t need or use is one way to do so, while paying off outstanding debt is another.

Make a deposit

Because car loans are assessed based on risk, borrowers can mitigate it by offering a deposit as part of the deal. Not only does this decrease the money your lender will have to transfer to you, but it shows them that you’re serious about paying off the loan. A welcome by-product of this is that paying a portion of your loan upfront decreases the amount you’ll need to pay interest on. For instance, putting a $10,000 deposit up on a $50,000 loan means that you’ll only need to pay interest on $40,000.

Show verifiable past borrowing

In addition to displaying a good credit score, showing your lender that you’ve successfully repaid a similar loan in the past will go a long way towards improving your approval chances. Income is only one part of the battle: demonstrating the discipline to make repayments on time each month is just as important. Lenders want to be confident that you have this discipline, so any past car loans will come in handy for your classic car finance.

Have a stable job and income

You’ll have to be earning enough to manage your repayments. For this type of finance, lenders prioritise borrowers who have job and income stability, such as full-time workers past probation and comfortably permanent. There’s a much higher chance of a casual worker’s employment being terminated or their work hours drying up than someone with full-time permanency.

Be asset-backed

Finally, applicants applying to finance old cars should have a strong profile and part of this is owning property. Applicants who own their home outright, have an existing investment portfolio or are currently paying off a home loan are the most likely to receive approval at a lower interest rate.

Frequently asked classic car loan questions

Yes – our flexible specialist lenders can approve car purchases from a dealer, private seller or auction house. This gives you greater choice when it comes to the cars you’re able to select for a collector car financing agreement, rather than restricting you solely to used car dealers.

Our partnered lenders who deal with classic car financing are experts in the field, so they’ll be able to give you a comprehensive valuation of the vehicle you’re hoping to buy. Alternatively, there are several reputable independent valuers that you can look to instead, although these tend to come with fees of up to $500 for doing so. In general, some of the factors that are considered when valuing classic cars include:

- Make and model

- Condition

- Modifications made to the car

- Kilometres on the odometer

- Engine type

- Scarcity

Yes – if you choose not to pursue a classic car loan, you can instead opt for an unsecured car (personal) loan. Because these don’t require any collateral, there are no restrictions on how you use the funds, meaning you can dedicate part of them to your car and other money towards paying for medical bills, home renovations or even your next holiday.

It’s important to note, though, that these come at higher interest rates than car loans for classic cars and have a lower borrowing cap of $75,000 (and sometimes lower).

The amount you can borrow when taking out a classic car loan depends on the value of the car itself, as the loan amount is directly tied to the purchase price. Many classic car loan providers will have valuation experts who can assess the car you want to purchase and establish its value. You can also engage the services of an independent classic car valuation specialist. Classic car lenders will want to see proof of the car’s value before they agree to lend you the purchase price.

Aside from the value, though, there are several factors specific to you that will determine your borrowing power, including:

- Your credit score

- Your income and expenses

- Your job stability

- Your lender's specific assessment criteria

Yes – most car loans will use the car in question as an asset to secure the loan, meaning that if you fail to meet your repayment obligations, the lender can repossess your car and then sell this to recoup their costs.

If the car isn’t accepted as security against the loan, or if you don’t want to use your classic car as security, you could opt for an unsecured personal loan instead.

Brands you can trust