- The Savvy Promise

At Savvy, our mission is to empower you to make informed financial choices. While we maintain stringent editorial standards, this article may include mentions of products offered by our partners. Here’s how we generate income.

In this article

As part of Savvy’s ongoing research into scams in Australia we collate data on the most searched for online scams.

- “PayID scams” are the most searched for, with 21,500 av. monthly searches.

- “Linkt scams” are second with 12,300 av. monthly searches.

- “PayPal scams” are searched for on average 7,100 times per month.

- Aussies search for “MyGov” scams on average 5,500 times per month.

- Facebook Marketplace scams get searched for 5,300 times per month, on average.

Despite our best efforts at thwarting them at the source, online scams are still prevalent in Australia.

Thanks to electronic media such as mobile phones, tablets, and laptops, we are confronted by scams every day. Though many scam attempts are foiled by junk or spam filters, spammers and scammers are on a constant mission to dodge detection and break though our defences. Unfortunately, as scam detection becomes more robust, scammers get more creative and sophisticated.

Due to massive public awareness and education campaigns, people are second guessing dodgy emails, “too good to be true” offers, and money seemingly appearing from nowhere. Savvy, as part of our ongoing consumer education efforts, have been researching the online search habits of Australians to determine what types of scams ordinary Australians are being exposed to.

Though search results are intent neutral, it does offer an insight into the volume of search interest in certain scams and when they are more likely to occur.

In this article, we delve into Australia’s most searched for scams, what they are, and how to protect yourself against them.

Average monthly internet search volume by scam type in Australia

No Data Found

Source: Ahrefs.com Keyword Research Tool Data – December 2023.

At a glance

Keyword research data offers useful insight into the interest Australians are showing in a particular topic, both on average and as a maximum.

Average search volume vs maximum search volume

In the below example, there are an average of 9,900 searches per month in Australia for the term, “payid scams”. When similar synonymous phrases are added together, the average search volume increases to 23,200 per month.

Main scams monthly Australian search volume

No Data Found

Source: Ahrefs.com Keyword Research Tool Data – December 2023.

Keyword search volume peak by month by main scam type

| Primary Keyword | June 2022 | July 2022 | Aug 2022 | Sep 2022 | Oct 2022 | Nov 2022 | Dec 2022 | Jan 2023 | Feb 2023 | Mar 2023 | April 2023 | May 2023 | "payid scams" | 90 | 118 | 248 | 917 | 4499 | 7439 | 20335 | 26567 | 18205 | 15465 | 14318 | 10966 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| "Linkt scam" | 117 | 390 | 6719 | 8095 | 21106 | 8391 | 5065 | 2196 | 3783 | 2873 | 1517 | 1209 |

| "Paypal scams" | 1297 | 1564 | 2347 | 2929 | 2909 | 2807 | 3511 | 4188 | 3151 | 5104 | 4593 | 3598 |

| "mygov scams" | 293 | 309 | 798 | 816 | 861 | 669 | 534 | 2163 | 2264 | 1427 | 896 | 1798 |

| "facebook marketplace scams" | 568 | 640 | 807 | 1228 | 1892 | 1634 | 2450 | 3677 | 2959 | 2979 | 3166 | 3186 |

Source: Ahrefs.com Keyword Research Tool Data – December 2023.

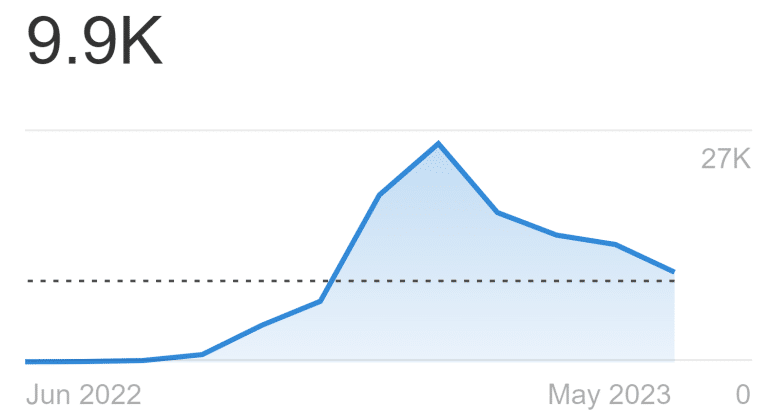

Maximum search volume for “payID scams”

Maximum search volume sheds further light on when interest in this topic peaked. As seen here, January 2023 was the peak month for “payID scams” searches, with 26,567 searches for this keyword alone. When added together, January search volume for “payID scams” and “payID scam” peaked at just under 39,000!

PayID scams

The most searched for scam online is the PayID scam. PayID, also known as Osko, is a form of electronic payment introduced in 2018 that offers instant deposits between bank accounts on the PayID system.

Instead of indicating the usual bank-state-branch (BSB) and account numbers on deposits, users may use a mobile phone, email address, ABN, or other unique identifier to instantly transfer money. The “old” way usually takes 1-2 business days. PayID was introduced (ironically) to minimise fraud by displaying the name associated with the account when an active PayID is entered into a deposit account field.

Looking at the data, there are approximately 9,900 searches for PayID scams per month with the highest monthly search volume coming in at 26,567 searches in January 2023. From June 2022 to May 2023, the average search volume for PayID scams and associated keywords (usually spelling variations) was 23,200.

According to ScamWatch, buying or selling scams accounted for $43.2m in losses to scammers over 2023.

January may be a high search month for PayID scams as people may be looking to offload unwanted Christmas presents or declutter for the new year and use PayID to speed up the transaction.

How to spot and avoid PayID scams

The most common PayID scam is conducted through online marketplaces such as Gumtree or Facebook Marketplace towards goods sellers. A scammer will accept whatever price you’ve set for your item and say that a friend or family member will collect the item on their behalf – sight unseen.

They will then insist on paying you via PayID. Once they have your information, they will forge documents or messages to indicate funds have been transferred or simply say they have transferred the funds in the hope you will see it as an honest mistake. Of course, no funds have been transferred at any time. The scammer will say that you need to use an upgraded form of PayID and make additional payments to release the funds.

These scams can look legitimate but are easy to spot once you know how. PayID is free – there are no additional charges associated with using PayID. Anyone insisting there are fees or additional charges is trying to scam you.

PayID is a protocol that banks use to transfer funds, not an entity. It is like saying that the HTTP protocol that helps transfer web pages to browsers is a similar entity. PayID cannot “contact” you like a bank or credit union, so any correspondence from “PayID” or “Osko” is fake.

Also, any legitimate buyer of goods will insist on inspecting the item before making a purchase.

“PayID scams” avg. search volume

Source: Ahrefs.com Keyword Research Tool Data – December 2023.

PayID scam keyword data – avg. vs max.

| Keyword | Av. Search Volume | Max. | Peak Date | "payid scams" | 9,900 | 26,567 | Jan 2023 |

|---|---|---|---|

| "payid scam" | 5,200 | 12,257 | Jan 2023 |

| "pay id scam" | 3,200 | 10,298 | March 2023 |

| "pay id scams" | 3,200 | 9,217 | April 2023 |

| Total: | 21,500 |

Source: Ahrefs.com Keyword Research Tool Data – December 2023.

Linkt scams

Linkt is toll road operator Transurban’s tolling business, issuing e-TAGs and tolling payments for toll roads in Melbourne, Sydney, and Brisbane. Though statistics on the exact number of users of toll roads vary, there have been over one million downloads of the official Linkt app on the Google Play store.

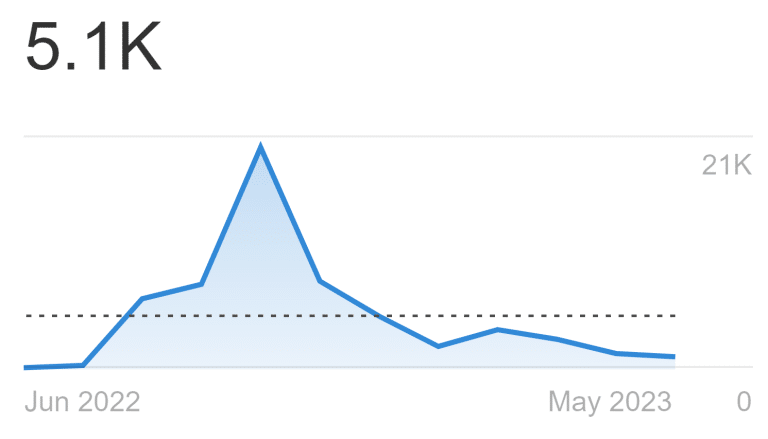

5,100 Australians search for Linkt scams on average, with a peak appearing in October 2022 with 21,106 searches. This may have been precipitated by media coverage at the time. The ABC reported a Gold Coast woman lost over $4,000 to a Linkt scam, sent over SMS. The Australian Consumer and Competition Commission said they received over 750 of these reports since January of that year. The amount lost to false billing scams such as these totalled over $26.3 million in 2023.

As such, the average search volume for “linkt scam text”, the most common form of scam, is 4,200 per month. It seems to hit a peak during holiday times such as Easter (3,905 for “linkt scam text” and 3,533 for “linkt scam SMS” in March 2023.)

How to spot and avoid Linkt scams

Linkt scams most commonly target SMS or text messaging.

The usual scam is that a message posing as Linkt will say that a customer’s account is overdue, has an unpaid bill, or that a recent direct debit has failed. These will be accompanied by a URL to a payment processor, which may resemble the Linkt website but is only designed to capture your financial information.

Other Linkt scams may come via email, which inform the customer that they have a rebate for unused toll credits. Scammers may also call you posing as Linkt and insist you settle your account, sometimes with gift cards.

The usual giveaway for these scams is that the scammer will have poor or erratic grammar or spelling, ask for urgent payment, and the URL of the payment gateway will not come from a legitimate Linkt site.

Also, Linkt will only ask for payment via credit card or direct debit using your official Linkt account.

If you are ever unsure, you can always check a legitimate Linkt or Transurban URL or page by visiting their anti-scam page, where you may also report scams to help Linkt crack down on this practice.

“Linkt scam” avg. search volume

Source: Ahrefs.com Keyword Research Tool Data – December 2023.

Linkt scam keyword data – avg. vs max.

| Keyword | Av. Search Volume | Max. | Peak Date | "linkt scam" | 5,100 | 21,106 | Oct 2022 |

|---|---|---|---|

| "linkt scam text" | 4,200 | 10,789 | Oct 2022 |

| "linkt toll scam" | 1,900 | 3,905 | March 2023 |

| "linkt scam sms" | 1,100 | 3,533 | March 2023 |

| "linkt scam messages" | 700 | 1,431 | Nov 2022 |

| "linkt text scam" | 700 | 1,871 | Feb 2023 |

| Total: | 12,300 |

Source: Ahrefs.com Keyword Research Tool Data – December 2023.

PayPal scams

As one of the world’s most popular online payment processors capturing 41.9% of the market and 435 million customers worldwide, encountering scams and phishing is an unfortunate reality for those who use the platform.

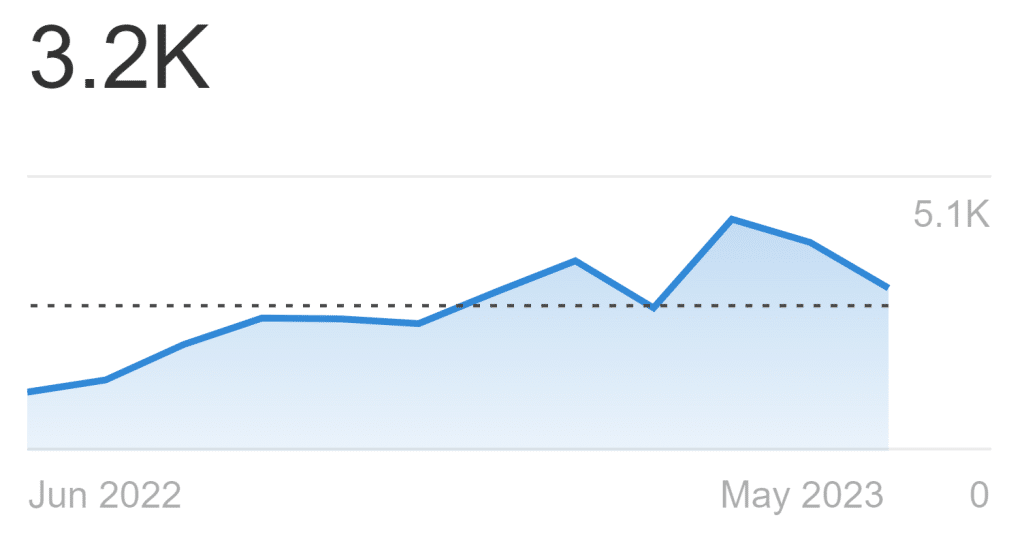

Australians search “PayPal scams” and associated terms 7,100 times per month on average, with the highest volume coming in March 2023 at 5,104. The search term “PayPal scam email” peaked in December 2022 with 2,008 searches.

There are many different attack methods used to scam people. These can range from email phishing, “too good to be true” offers, and hoax websites.

How to spot and avoid PayPal scams

PayPal scams come in many forms but have telltale signs you can use to spot them.

Phishing emails may land in your inbox insisting you have paid for an item or requesting payment for an item. The email may prompt you to click a link to settle the bill, which leads to a hoax website. PayPal itself says its website uses HTTPS (HTTP Secure) and has one legitimate URL (paypal.com.)

These emails may use poor grammar, false links, out of date or out of place logos, inconsistent branding, and generic greetings such as “dear user” or “Hello PayPal customer.”

Many common scams centre on using PayPal to pay scammers who are posing as friends or family asking for money, “too good to be true” item offers, lottery wins, or unsolicited work from home job offers.

People may call you posing as PayPal to “confirm” a purchase that does not exist, where they will manipulate you into thinking they have refunded more than the purchase price of the item into your bank account, whereby you send back the “difference,” usually in gift cards.

PayPal says that it never asks for bank account numbers, passwords, credit card numbers, or other credit data over email, phone, or SMS. PayPal uses government regulated “Know Your Customer” technology within the app or website to verify customer information.

If you’re ever unsure about communication from PayPal, forward the suspect email to their anti-phishing department.

It is also wise to enable two-factor authentication on your PayPal account to avoid hacking attempts.

“PayPal scams” avg. search volume

Source: Ahrefs.com Keyword Research Tool Data – December 2023.

PayPal scam keyword data – avg. vs max.

| Keyword | Av. Search Volume | Max. | Peak Date | "PayPal scams" | 3,200 | 5,104 | March 2023 |

|---|---|---|---|

| "PayPal scam" | 2,700 | 4,400 | March 2023 |

| "PayPal scam email" | 1,200 | 2,008 | Dec 2022 |

| "PayPal scam text" | 800 | 2,644 | April 2023 |

| "PayPal scam emails" | 800 | 1,303 | Dec 2022 |

| Total: | 7,100 |

Source: Ahrefs.com Keyword Research Tool Data – December 2023.

MyGov scams

Almost every Australian citizen or permanent resident has interacted with MyGov, the Australian Government’s online services portal at least once in their lives – and many use it regularly.

MyGov centralises almost every Government service such as Medicare, Centrelink, the Australian Taxation Office, Workforce Australia, the NDIS, Department of Veteran’s Affairs, My Aged Care, and more.

As such, this is ripe for scammers trying to target vulnerable people. According to ScamWatch, $8.1 million was lost to identity theft during 2023.

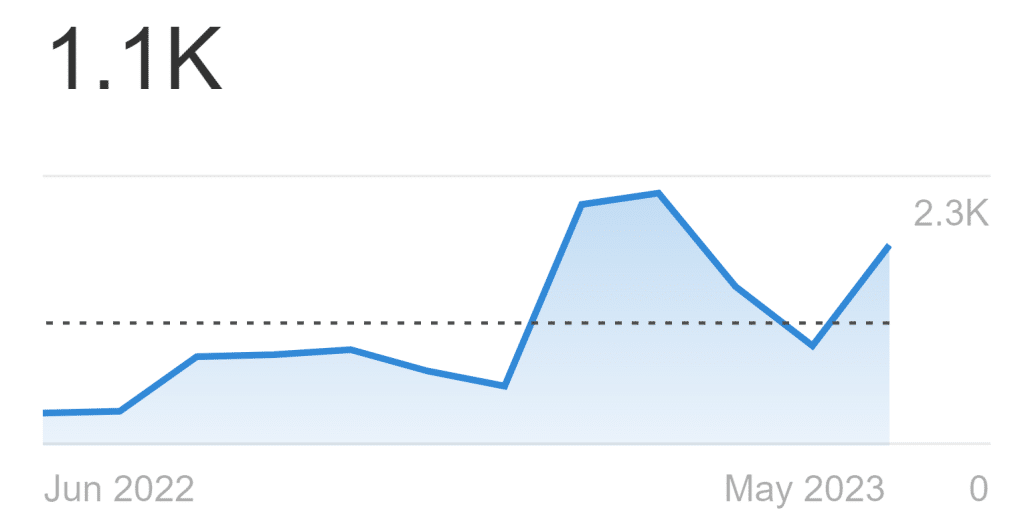

5,500 Australians search for “MyGov scams” or associated keywords on average, with noticeable peaks in February 2023 (2,264 searches; 2,524 searches for “mygov scam.”)

A spate of emails or SMS messages claiming to come from MyGov and the Australian Taxation Office about an additional tax refund appeared in January 2023, as highlighted by the Australian Communications and Media Authority. These were phishing scams trying to gain access to personal financial information.

How to spot and avoid MyGov scams

You can keep track of active scams using MyGov’s page on the subject here.

MyGov scams will usually try to impersonate the given department (Centrelink, ATO, etc.) using their branding. MyGov does not send correspondence directly to your address; they instead generate a notification asking you to login to MyGov and view the letter directly. Your email will also have your Customer Reference Number – scammers will usually use a generic “dear user” or “dear Centrelink customer” greeting instead.

Of course, these emails may be impersonated. Be sure you are clicking on a legitimate MyGov link (my.gov.au)

MyGov will never ask for personal details through email, SMS, social media, or direct message.

You can report a MyGov Services Australia scam at [email protected]

Only ever use the MyGov app as downloaded through Apple’s App Store or Google Play.

You can further protect yourself by turning on two-factor authentication, which generates a one-time code when you attempt to login to MyGov.

“Mygov scams” avg. search volume

Source: Ahrefs.com Keyword Research Tool Data – December 2023.

Mygov scam keyword data – avg. vs max.

| Keyword | Av. Search Volume | Max. | Peak Date | "mygov scams" | 1,100 | 2,264 | Feb 2023 |

|---|---|---|---|

| "mygov scam" | 1,100 | 2,524 | Feb 2023 |

| "mygov scam email" | 1,000 | 3,710 | Jan 2023 |

| "my gov scams" | 800 | 2,024 | Feb 2023 |

| "my gov scam" | 800 | 1,855 | Jan 2023 |

| "mygov refund scam" | 700 | 1,741 | Jan 2023 |

| "mygov scam text" | 700 | 2,294 | Feb 2023 |

| Total: | 5,500 |

Source: Ahrefs.com Keyword Research Tool Data – December 2023.

Facebook Marketplace scams

Another one of Australia’s most searched for scam topics is Facebook Marketplace scams. This feature was introduced into Facebook in 2016 to help users buy and sell items locally and abroad, as an alternative to Gumtree and other similar classifieds sites. Almost half of Australians use Facebook according to Statista; 11.56 million.

Australians search for “facebook marketplace scams” and affiliated keywords 3,100 times on average, with a peak emerging in January 2023 with 3,677 searches (and 2,030 searches for “fb marketplace scams.”)

As discussed, January is a popular time for selling unwanted goods and starting fresh for the new year.

How to spot and avoid Facebook Marketplace scams

There are many different variations on Facebook Marketplace scams, whether you are a buyer or a seller. Sellers may be targeted with the PayID scams as mentioned above; and “buyers” may ask for additional information such as email addresses so they can bombard your inbox with phishing emails and/or potential malware.

Scammers will usually have a poor command of English, ask for the item using its full listing name or awkward phrasing, (e.g. “Is the ASUS Strix RTX 3080 Graphics Card – Good Condition still for sale?”), insist on payment for the item sight unseen, and provide fake payment confirmation.

You should always check your bank account, PayPal or other payment wallet for official confirmation before sending goods to anyone on Facebook Marketplace.

Another common scam is the rental scam. A spacious and well-appointed property in a good location appears on Facebook Marketplace for lower-than-market asking price. The property may be listed on other sites, but in order to inspect the property the “agent” will ask for a holding deposit. Once you send them any money, they disappear.

If you suspect the person you are dealing with is a scammer, try to see if the buyer/seller has a good track record or if their account is new. You can check this by using the Seller Information module on the right-hand side of the listing. If it’s too good to be true or doesn’t look like it’s on the up and up, walk away and report the listing using the three-dot menu below the message field.

“Facebook marketplace scams” avg. search volume

Source: Ahrefs.com Keyword Research Tool Data – December 2023.

Facebook marketplace scams keyword data – avg. vs max.

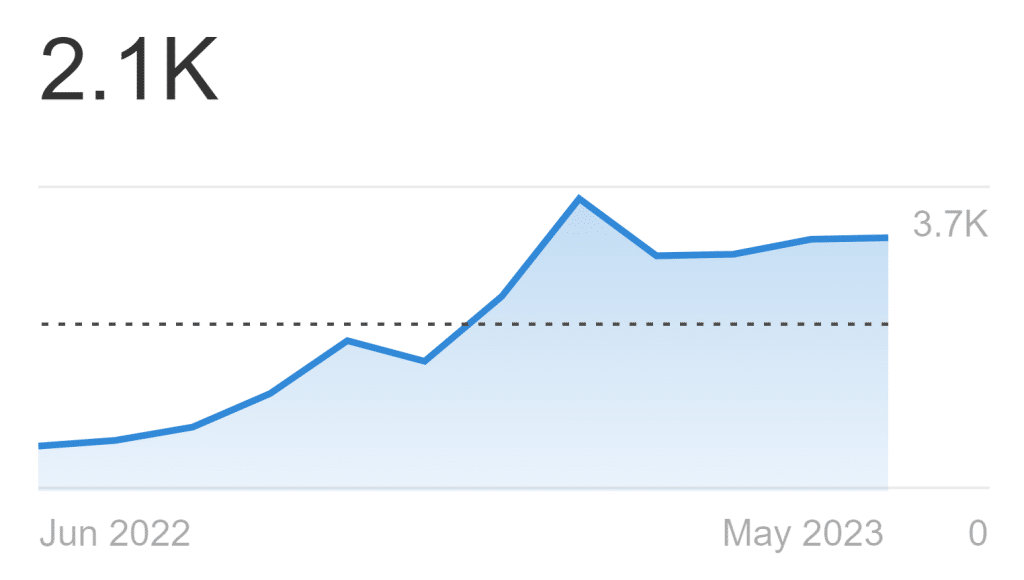

| Keyword | Av. Search Volume | Max. | Peak Date | "facebook marketplace scams" | 2,100 | 3,667 | Jan 2023 |

|---|---|---|---|

| "fb marketplace scam" | 1,000 | 2,030 | Jan 2023 |

| "facebook scams" | 500 | 755 | May 2023 |

| "payid scams marketplace" | 900 | 3,689 | Dec 2022 |

| "payid scam marketplace" | 800 | 2,268 | Dec 2022 |

| Total: | 5,300 |

Source: Ahrefs.com Keyword Research Tool Data – December 2023.

Savvy spokesperson, Adrian Edlington, looks at how the number of online searches for different scam-related keywords reflects the level of interest of these in Australia:

“In our ongoing consumer education efforts, we analyse Ahrefs search data to unveil what scams Australians are actively searching for and when. The interest in scams like PayID, Linkt, PayPal, MyGov, and Facebook Marketplace fluctuates, revealing peak times and trends. This article explores the insights gained from Ahrefs data, shedding light on the evolving landscape of online scams.” he says.

If you suspect you are being or have been scammed:

- Never open any email attachments coming from suspected scammers.

- Forward any suspicious emails or SMS to the company to make sure.

- Never reply to the scammer.

- If you are buying or selling large goods ($200+), insist on meeting beforehand. If they are cagey or refuse, walk away.

- If you have sent money or personal information to a scammer, you should contact your bank immediately.

- You will need to act fast to prevent losses. The ScamWatch website has resources to help protect yourself.

- Keyword research data, Ahrefs.com Keyword Research Tool Data - December 2023

- According to ScamWatch, Scam Watch, Scam Statisitics, 2023

- ABC.net.au, Linkt scam, Australian Broadcasting Company

- Linkt scams most commonly target SMS or text messaging

- Phishing emails, PayPal

- Australian Communications and Media Authority, ACMA

- Active scams, Services Australia

- Almost half of Australians use Facebook, Statista

- ScamWatch website has resources to help protect yourself, ScamWatch

Did you find this page helpful?

Author

Adrian EdlingtonPublished on December 22nd, 2023

Last updated on March 8th, 2024

Fact checked

This guide provides general information and does not consider your individual needs, finances or objectives. We do not make any recommendation or suggestion about which product is best for you based on your specific situation and we do not compare all companies in the market, or all products offered by all companies. It’s always important to consider whether professional financial, legal or taxation advice is appropriate for you before choosing or purchasing a financial product.

The content on our website is produced by experts in the field of finance and reviewed as part of our editorial guidelines. We endeavour to keep all information across our site updated with accurate information.