- The Savvy Promise

At Savvy, our mission is to empower you to make informed financial choices. While we maintain stringent editorial standards, this article may include mentions of products offered by our partners. Here’s how we generate income.

In this article

A recent survey conducted by Savvy has revealed 91.6% of Australians agree that property prices are becoming “unaffordable” in the current market.

- 32.4% Cannot afford property as prices are too high

- 26% believe foreign ownership is to blame

- 37.1% of respondents who bought were concerned about being left behind

- Two-thirds believe JobKeeper/Seeker stimulus is unlikely to have effect on prices

The survey polled 905 Australians about their attitudes and behaviours regarding housing affordability. 9.8% of those polled said they had purchased a property during the COVID-19 pandemic; 27.6% said they are considering buying within the next twelve months.

Almost a third of respondents (32.9%) are “very worried” that the current housing market is out of the reach of ordinary Australians. 39.3% said they “worried”, bringing the total of those concerned to almost three-quarters: 72.2%.

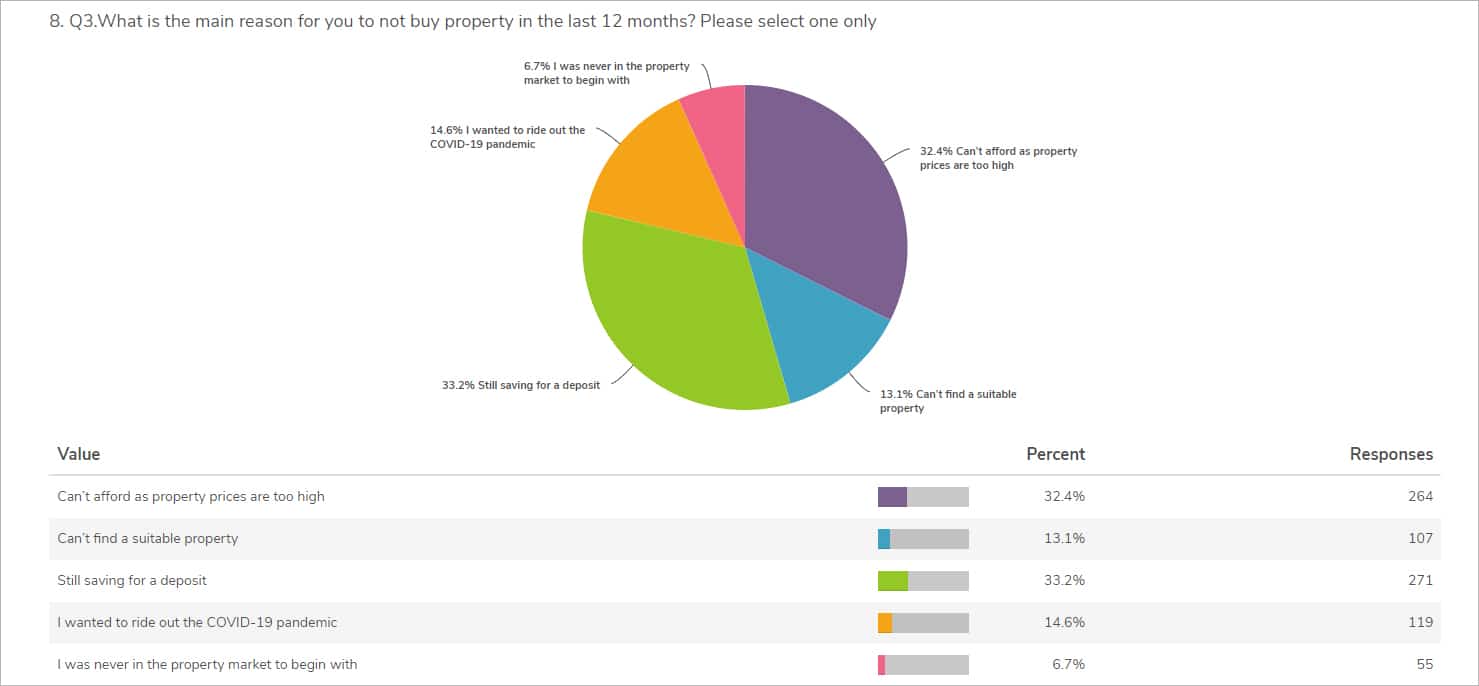

Main reason not to buy property

The main reason respondents cited for holding off on buying is that they are still saving for a deposit (33.2%) followed by general housing unaffordability (32.4%). 14.6% of respondents said they were waiting to ride out the COVID-19 pandemic.

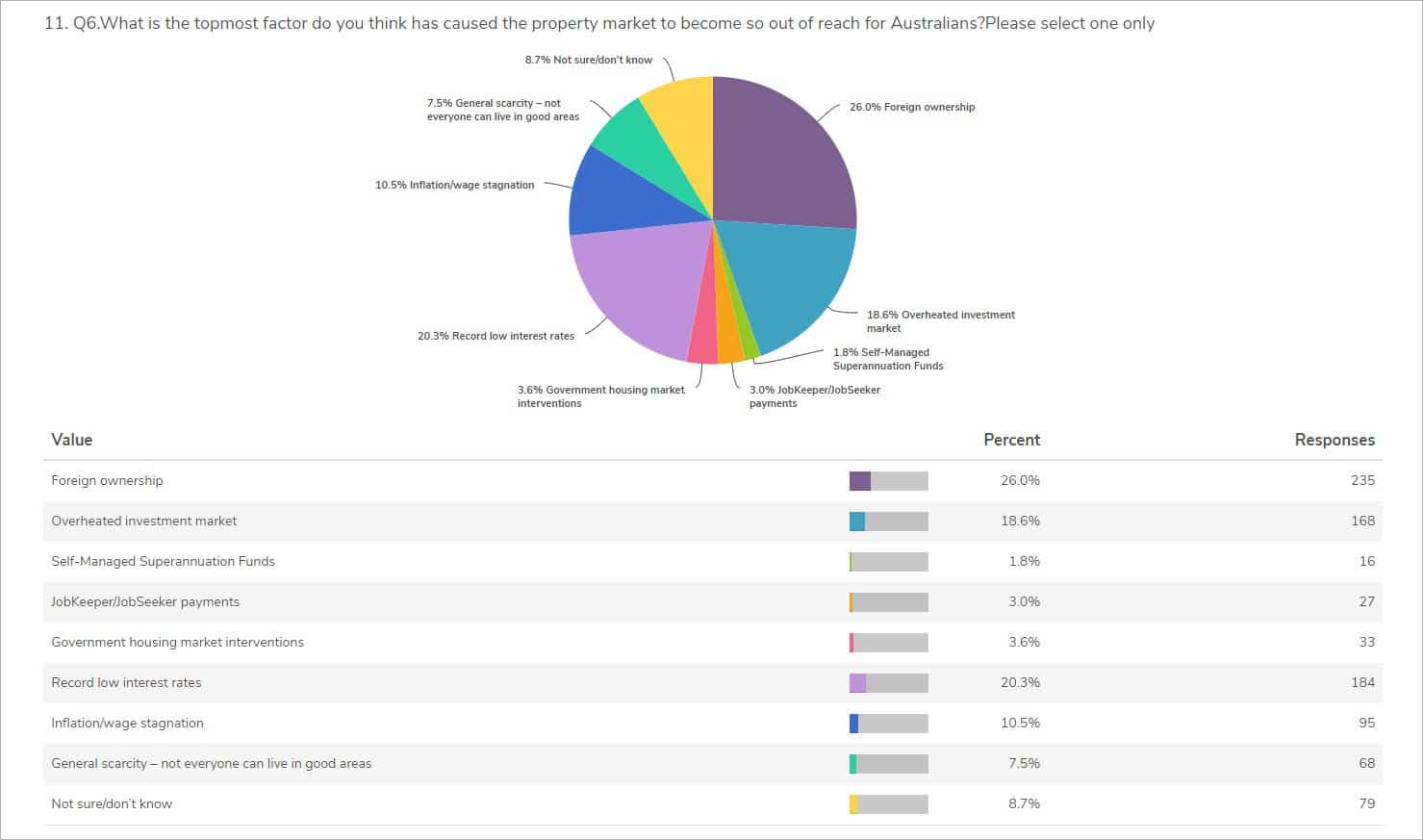

Top reasons why property market has become out of reach

This leaves many would-be home buyers in a double bind, as 28.6% say that they’re concerned if they don’t buy soon, they’ll be left behind.

When asked why property has become so out of reach, 26% cite foreign ownership as the reason, followed by record low interest rates (20.3%) and an oversaturated investment market (18.6%). 33.9% of people said that the end of JobKeeper/Seeker stimulus will force down prices, when asked if the measures had any impact on the real estate market.

Further, 29.8% said they were prepared to devote 20% of household income to home loan repayments; 25.7% said 30%; a staggering 20.6% said over 30%+.

Devoting over 30% of household income toward mortgage repayments is considered “mortgage stress” in the finance industry. 26.9% of those surveyed said they are currently experiencing mortgage stress.

Savvy Managing Director Bill Tsouvalas says that this should be cause for concern. “We’ve had a general feeling that the housing market is out of reach for Australians, but it seems that COVID-19 and other measures such as HomeBuilder and the First Home Buyer Deposit Scheme has still left most would-be home buyers worried if they don’t buy now, they’ll be shut out forever. The fact that almost a third of people are in mortgage stress is also alarming; it could be prelude to a much bigger correction.”

27% said they would save more of a deposit to secure their place in the property market; 23.7% said they’re waiting for a price crash. 21% are prepared to relocate in a regional or rural area.

Savvy - 2021 Property Affordability Survey - 2 (n = 905)

Nationally representative survey of 905 adult Australians, aged 18 and over. Conducted by Octopus Group, on behalf of Savvy.

Completion date: 25/03/2021

Age groups:18-24, 25-34, 35-44, 45-54, 55-64, 65+

Did you find this page helpful?

Author

Adrian EdlingtonGuest Contributor

Bill TsouvalasPublished on April 20th, 2021

Last updated on March 19th, 2024

Fact checked

This guide provides general information and does not consider your individual needs, finances or objectives. We do not make any recommendation or suggestion about which product is best for you based on your specific situation and we do not compare all companies in the market, or all products offered by all companies. It’s always important to consider whether professional financial, legal or taxation advice is appropriate for you before choosing or purchasing a financial product.

The content on our website is produced by experts in the field of finance and reviewed as part of our editorial guidelines. We endeavour to keep all information across our site updated with accurate information.