Home > Health Insurance > Average Cost Of Health Insurance In Australia

Average Cost Of Health Insurance In Australia

Find out how much health insurance costs on average in Australia and compare quotes through Savvy.

Author

Savvy Editorial TeamFact checked

Are you wondering what the average cost of health insurance is in Australia? Although average costs vary depending on the state you live in, the type of policy you want, and how many people the policy is for, you can find examples of the cost of different types of policies right here.

Find out the cost of a range of health insurance policies including basic, bronze, silver and gold hospital cover policies, plus extras cover policies too. Compare prices right here through Savvy today.

What is the average cost of private health insurance in Australia?

Enquiring about the average cost of health insurance in Australia is akin to asking how much does a car cost? The answer is there are hundreds of different health insurance policies available, offered by over 35 health funds. The cost naturally depends on a range of variables, such as:

- the type of policy you want to buy (hospital, extras, or a combination policy)

- how many people that policy needs to cover

- your budget, and whether you can afford a high-tier policy, or require cheaper cover

These are some examples of the cost of health insurance from some of Australia’s leading insurers. Costs don’t take into consideration any private health insurance rebates the Government may offer, age-based discounts or Lifetime Health Cover loadings:

Hospital cover*

Based on prices for a single person living in Victoria earning less than $90,000 p.a. with $750 excess:

Extras cover*

Examples of the cost of basic level and comprehensive extras cover policies:

Prices based on the cost of an extras policy for a single person in Victoria.

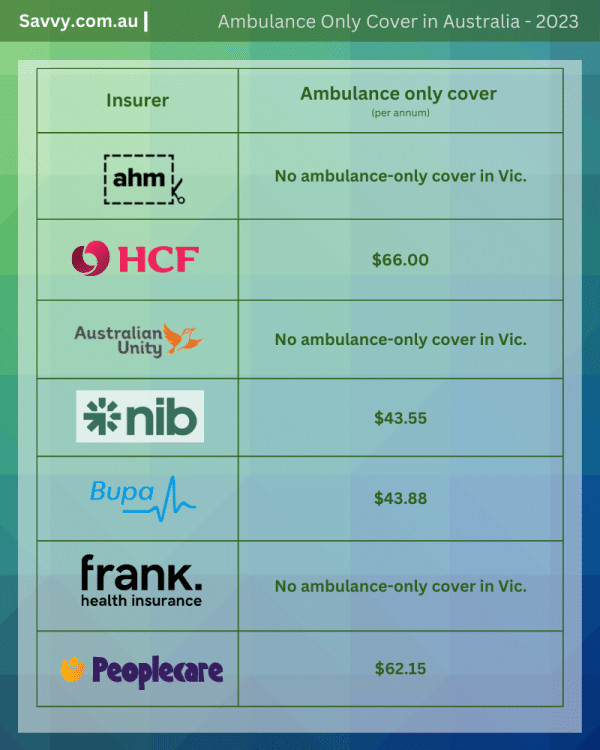

Ambulance cover*

Ambulance cover is frequently provided along with hospital cover, or bundled up with extras cover by some health insurers, depending on where you live in Australia. This is because some state governments (such as the Queensland Government), provide free ambulance cover for their residents, so additional private health insurance for ambulance cover is not required by residents of that state.

The cost of ambulance cover can vary significantly depending on which state of Australia you live in. Not all health insurance providers offer standalone ambulance cover in all states and territories. These are some examples of the cost of ambulance cover in Victoria for a single person.

*All prices are current for May 2023 but subject to change over time.

What types of private health insurance are available in Australia?

In Australia, there are typically three main types of health insurance cover on offer:

- Hospital cover: hospital cover is designed to provide coverage for hospital expenses, including inpatient treatments, surgeries and accommodation in a private hospital. It typically covers costs such as room fees, nursing care, operating theatre fees and prescribed medications while in hospital. Hospital cover may also include coverage for emergency ambulance services, mental health treatments and rehabilitation services, depending on the level of cover you buy.

- Extras cover: extras cover, also known as general or ancillary cover, is designed to provide coverage for services which typically aren’t covered by Medicare, which is the public health system in Australia. This may include services such as dental treatments, optical services, physiotherapy, chiropractic treatments and other allied health services. Extras cover policies may also provide coverage for hearing aids, orthodontics, and other health-related services provided out of a hospital setting.

- Combined cover: combined cover, as the name suggests, is a combination of both hospital cover and extras cover. It can provide coverage for both hospital and extras services, offering a potentially comprehensive health insurance solution for those looking for cover for treatments both within and outside hospital.

What different levels of hospital cover are available?

Hospital cover is subdivided into different levels of cover, including basic, bronze, silver, and gold hospital cover. The clinical conditions covered by each level of cover are regulated by the Australian Government, making it easier to compare apples with apples. For example, all silver tier policies must offer cover for a set number of clinical categories, so if you want to compare silver policies you know you’re comparing a similar level of cover. If a policy is called a ‘plus’ policy, it means that policy offers cover for more areas than the minimum government-regulated clinical categories.

- Basic hospital cover: this tier of hospital cover is the cheapest level of hospital cover available in Australia. It provides coverage for just three limited treatment categories (mental health services, rehabilitation and palliative care).

- Bronze hospital cover: bronze hospital cover offers more comprehensive cover than basic hospital cover, including coverage for a further 18 clinical categories. It’s a popular choice for those who want more coverage than basic hospital cover, but still have a limited budget.

- Silver hospital cover: silver hospital cover provides a higher level of coverage compared to basic and bronze hospital cover, including cover for a broader range of treatments and services. For example, it may also include coverage for reconstructive surgery, dental surgery, the implantation of hearing devices and podiatric surgery. Silver hospital cover is suitable for those who want more comprehensive insurance but may not need coverage for all services.

- Gold hospital cover: gold hospital cover offers the highest level of cover available. It provides coverage for a wide range of treatments and services, including comprehensive coverage for all 38 clinical categories. It is popular amongst those who want the highest level of cover, and are willing to pay a higher premium for comprehensive coverage.

Hospital cover excess amounts

In addition to four different tiers of hospital cover, there are also various excess amounts available too.

An excess is the amount you agree to pay towards the cost of hospital treatment before your health insurance coverage kicks in. It's an upfront cost which you’ll be required to pay out of pocket, in addition to your regular premiums, when you receive hospital treatment.

Excess amounts may vary from zero to $750 and can be chosen by the policyholder when they select their policy. Typically, the higher the excess amount you choose, the lower your premium may be, as you’re taking on a higher portion of the cost of your hospital treatment.

For example, if you have a hospital excess of $500 and are admitted to hospital for a covered treatment costing $5,000, you would need to pay the $500 excess amount upfront and your health insurance would cover the remaining $4,500 of the cost.

Levels of extras cover available:

- No-frills extras cover can provide coverage for essential ancillary services, such as general dental, optical, and physiotherapy. Basic extras cover is typically the most affordable type of extras cover, and is suitable for those who have minimal need for ancillary services.

- Medium-priced extras cover can offer more comprehensive coverage than the cheapest basic policy, and can include coverage for a wider range of ancillary services such as major dental, orthodontics, and psychology services. It may include limited cover for services such as chiropractic, podiatry and speech services, hearing aids and occupational therapy. Medium extras cover is a popular choice for those who want greater coverage for a broader range of ancillary services at a more affordable price.

- The highest-cost comprehensive extras cover policies generally provide the widest level of cover available. Such policies can include coverage for a wide range of ancillary services, including general and major dental, optical, physiotherapy, psychology services, orthodontics, hearing aids, podiatry and more. This cover is popular among those who want the highest level of coverage for ancillary services and are willing to pay a higher premium.

How many people can be covered by a health insurance policy?

Health insurance policies are typically tailored to different family circumstances, with options available for singles, couples, single parents, and families. Naturally the cost of health insurance policies varies depending on how many people are covered under the one policy.

- Singles policies: these policies are designed for individuals who aren’t in a relationship and have no dependents. They’re available in all four tiers of hospital cover and a wide variety of extras levels.

- Couples policies: couples policies are designed for two people who are in a relationship, whether married or de facto. They can provide coverage for both individuals under a single policy and the level of coverage can be adjusted based on the health needs and preferences of the policyholders.

- Single parent policies: single parent policies are designed for single parents who have dependent children. These policies provide coverage for both the parent and their children, offering financial protection for medical expenses related to both the parent and the children's healthcare needs.

- Family policies: family policies are designed to cover the entire family, including the policyholder, their spouse or partner, and their dependent children. These policies may offer comprehensive coverage for the entire family.

More questions about the average cost of health insurance in Australia

Health insurance in Australia is community-rated, which means unlike life insurance, everyone pays the same for the same level of health insurance regardless of age or pre-existing health conditions. However, your age will have some influence on how much you pay, as there are age-related discounts available for young adults (those aged under 30) through some insurers, while older Australians are also able to claim a higher percentage of private health insurance rebate on their tax returns.

Several health insurance providers in Australia offer options to customise extras policies. Such policies are known as flexible extras policies and can give the customer a choice of the types of healthcare to be covered, up to a set policy limit.

Yes – both hospital cover and extras health insurance policies may have waiting periods before you can make a claim. These can range from two months up to 12 months for pre-existing conditions, which is why it’s important to compare policies through Savvy so you have a clear understanding of the range of policies available, and the different waiting periods which may apply.

Yes – you can request a call-back here through Savvy and a health insurance specialist will phone you to help you with your decision and to make sure you have all the required information from our panel of trusted health insurers to buy a relevant policy suitable for your needs.

Yes – there’s a Medicare Levy Surcharge (MLS) which may apply to higher-income earners who do not have private health insurance and do not qualify for an exemption. The MLS is an additional tax (ranging from 1% to 1.5%) which is calculated based on your income if you earn over $90,000 p.a.

Helpful health insurance guides

Compare health insurance policies online

Disclaimer:

Savvy is partnered with Compare Club Australia Pty Ltd (AFS representative number 001279036) of Alternative Media Pty Ltd (AFS License number 486326) to provide readers with a variety of health insurance policies to compare. Savvy earns a commission from Compare Club each time a customer buys a health insurance policy via our website. We don’t arrange for products to be purchased from these brands directly, as all purchases are conducted via Compare Club.

Savvy’s comparison service is provided by Compare Club. Compare Club compares selected products from a panel of trusted insurers and does not compare all products in the market.

Any advice presented above or on other pages is general in nature and doesn’t consider your personal or business objectives, needs or finances. It’s always important to consider whether advice is suitable for you before purchasing an insurance policy.

For any further information on the variety of insurers compared by Compare Club or how their business works, you can read their Financial Services Guide.